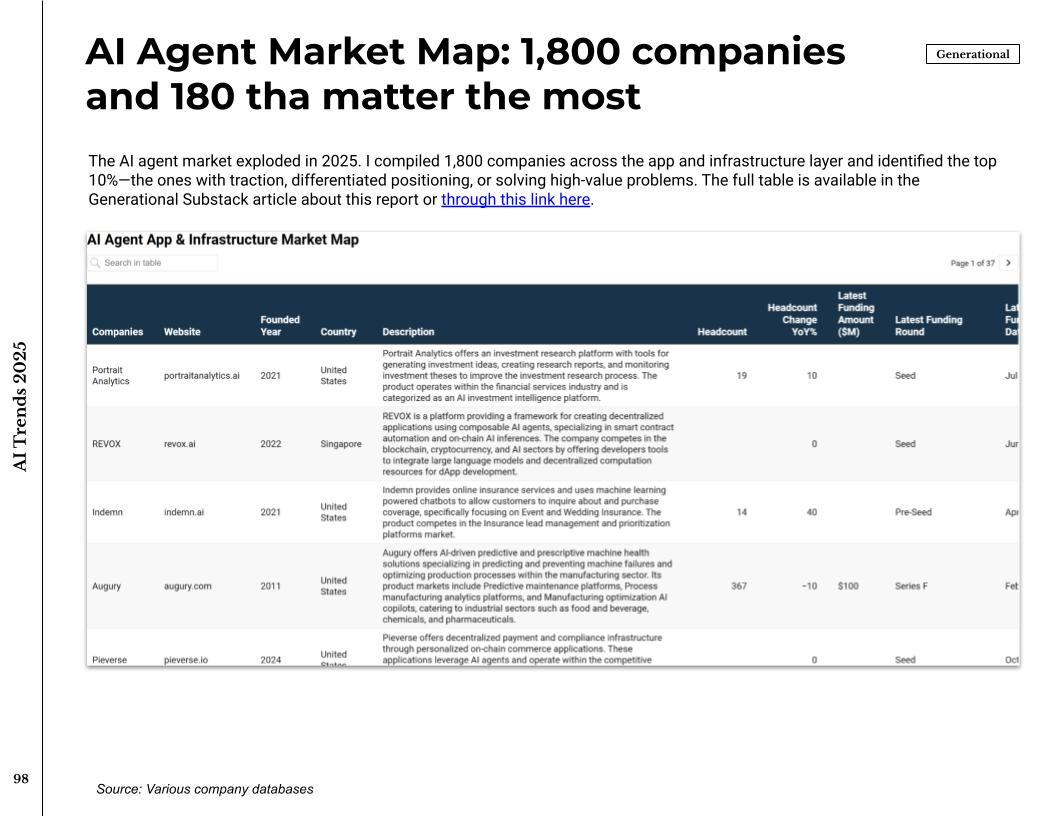

The AI Trends 2025 report is here—fully updated as of 12/30/2025. It has over 100 pages, covering everything from the big picture to scaling laws, along with proprietary analysis. It also has a market map of over 1,800 AI startups, highlighting the top 10% that matter most.

This article summarizes the key findings of the report with screenshots and an AI agent market map. For full report and database:

-

Multimedia and PDF versions of the report: Add

-

AI Agent Market Map: Add or go to the bottom of the article

This is the fourth edition of my annual AI Trends report. I started writing these in 2022, before ChatGPT launched, and it’s been something else to watch this technology grow from an academic curiosity to an economic force.

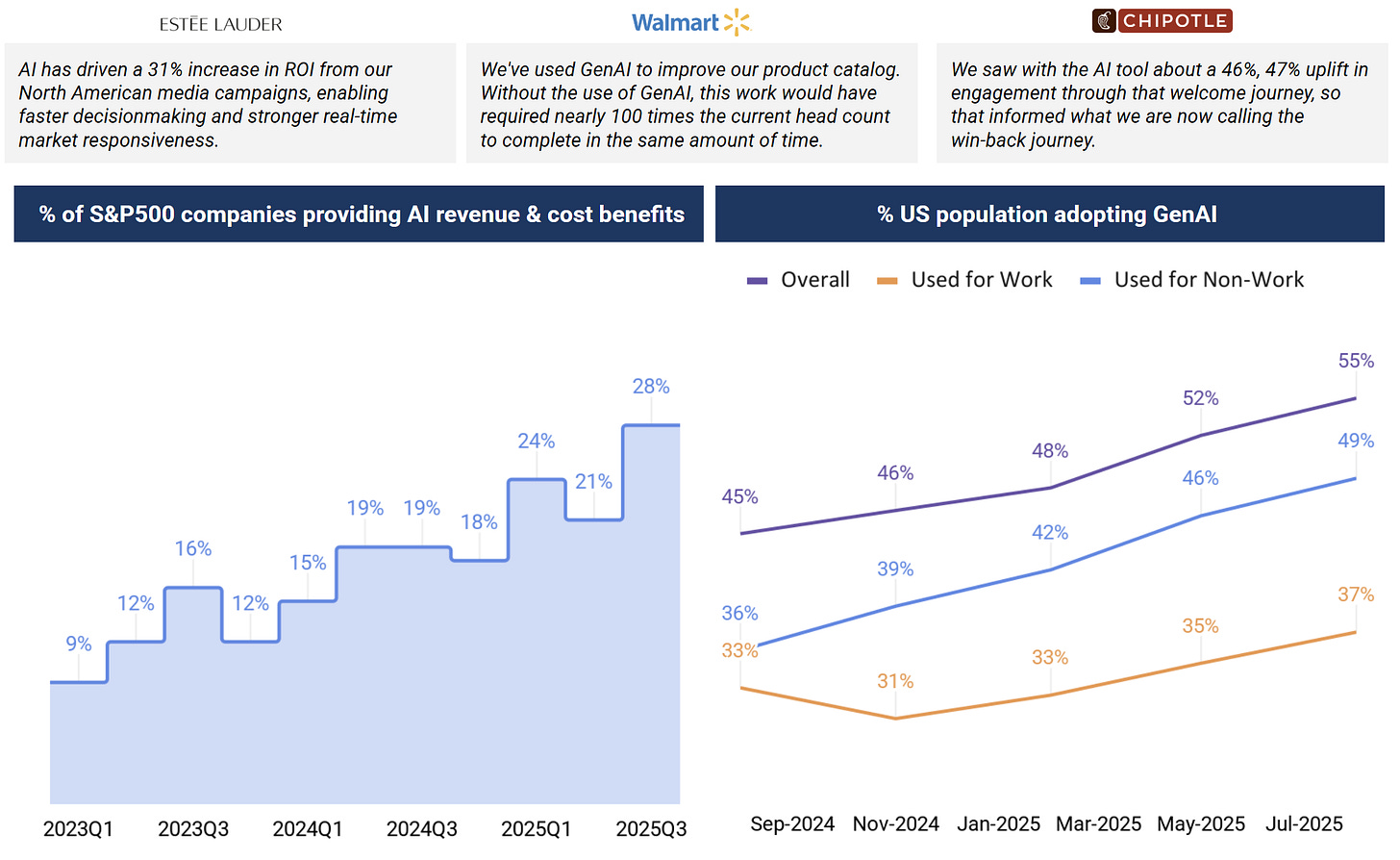

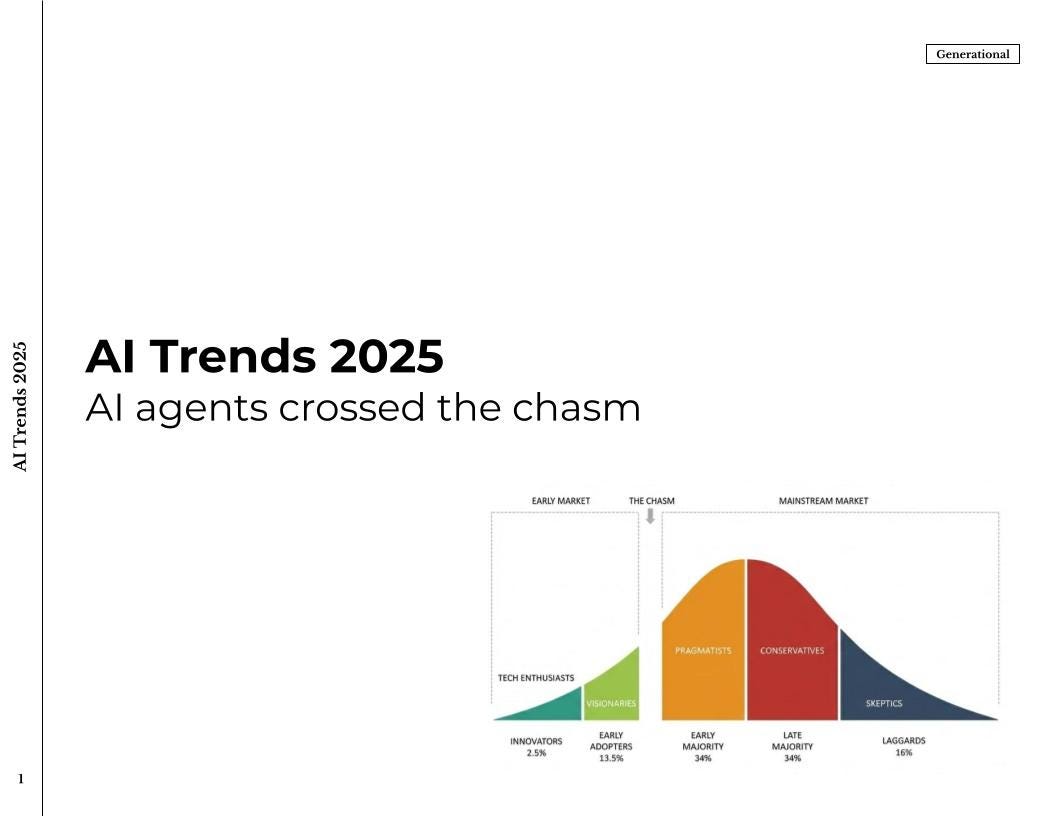

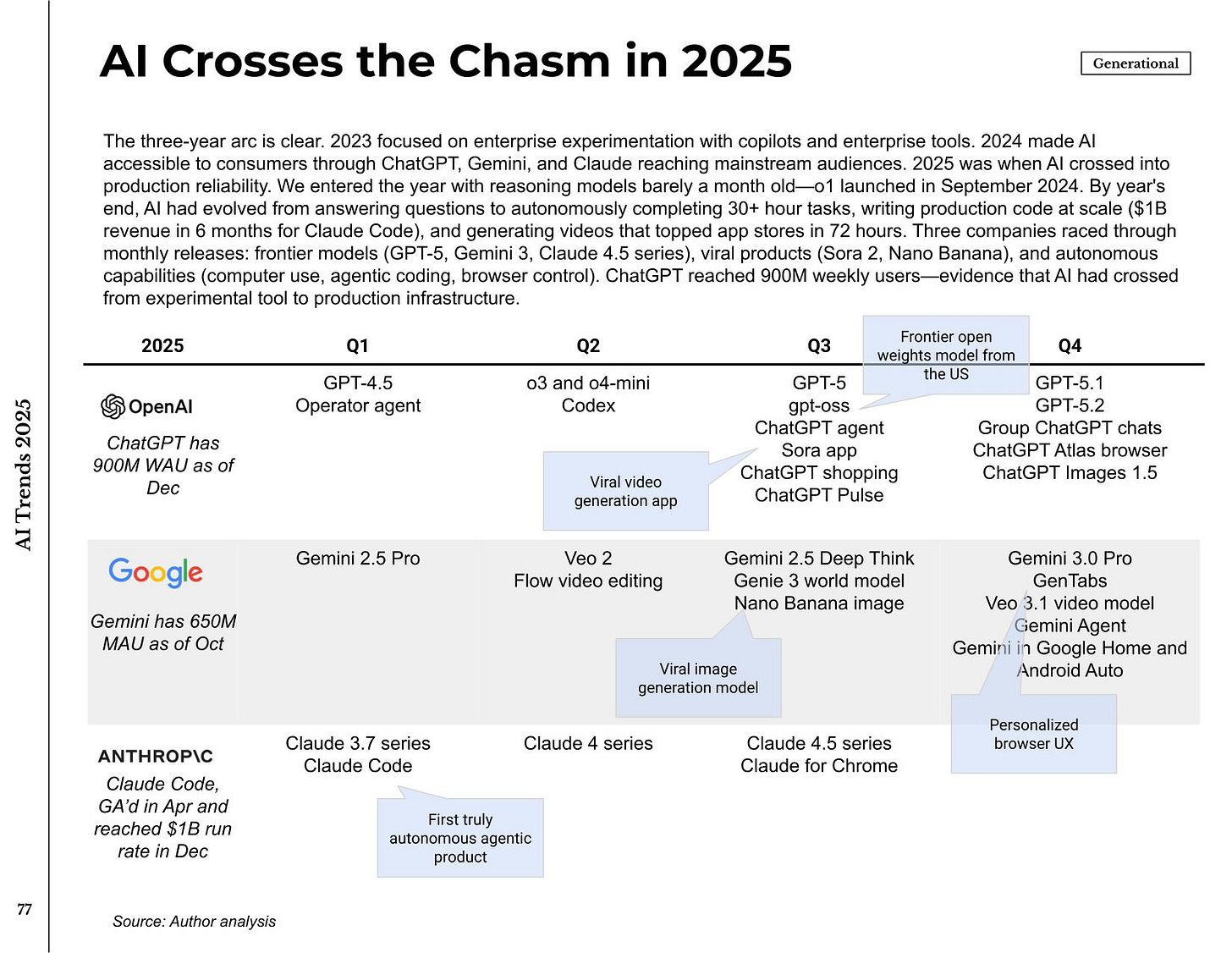

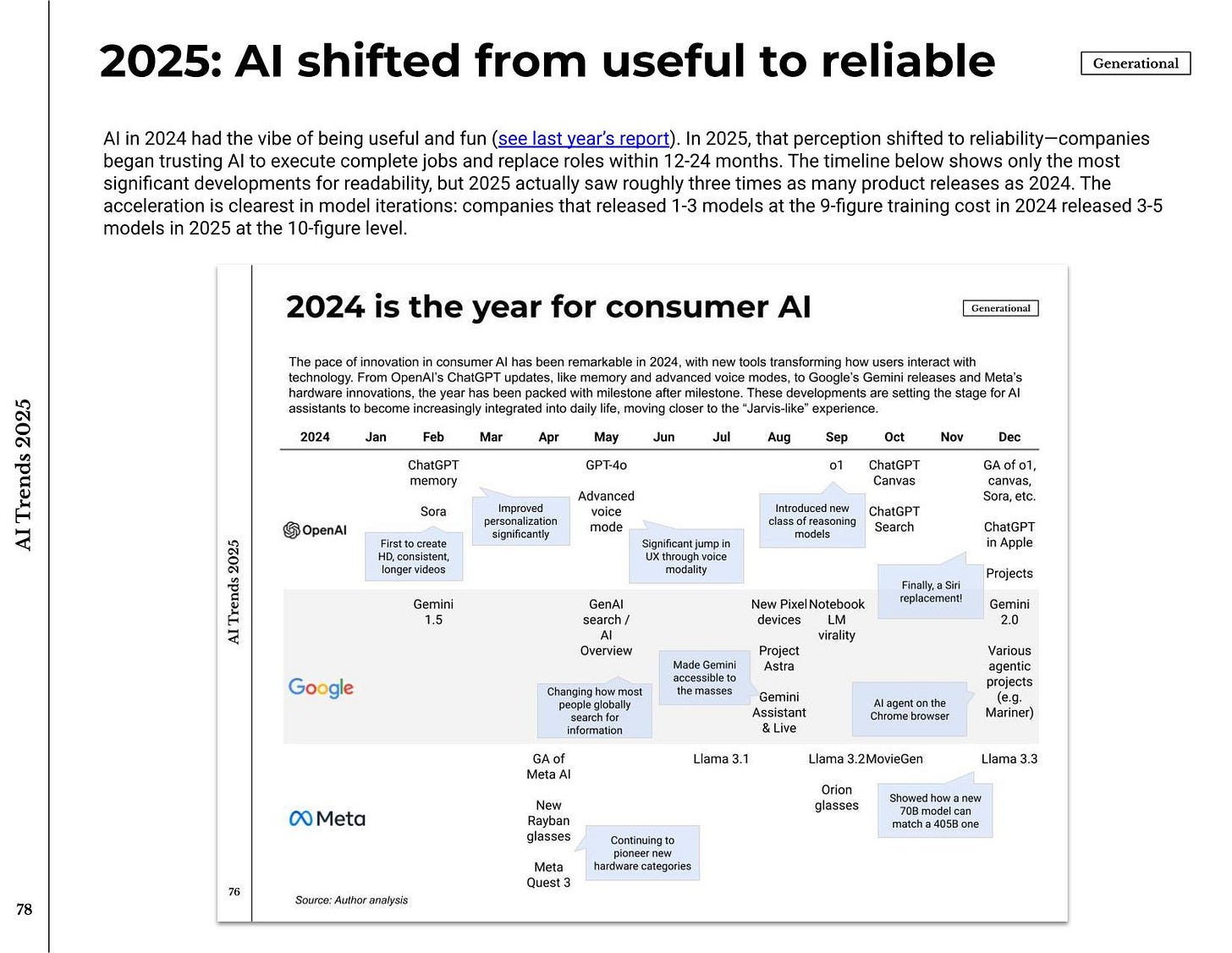

This year’s report is titled “Crossing the Chasm” because that’s what the data shows: Generative AI has moved from early adopters to mainstream production use. It’s no longer about capacity – it’s generating real revenue, displacing real labor, and facing real physical constraints.

I think the following findings are most important.

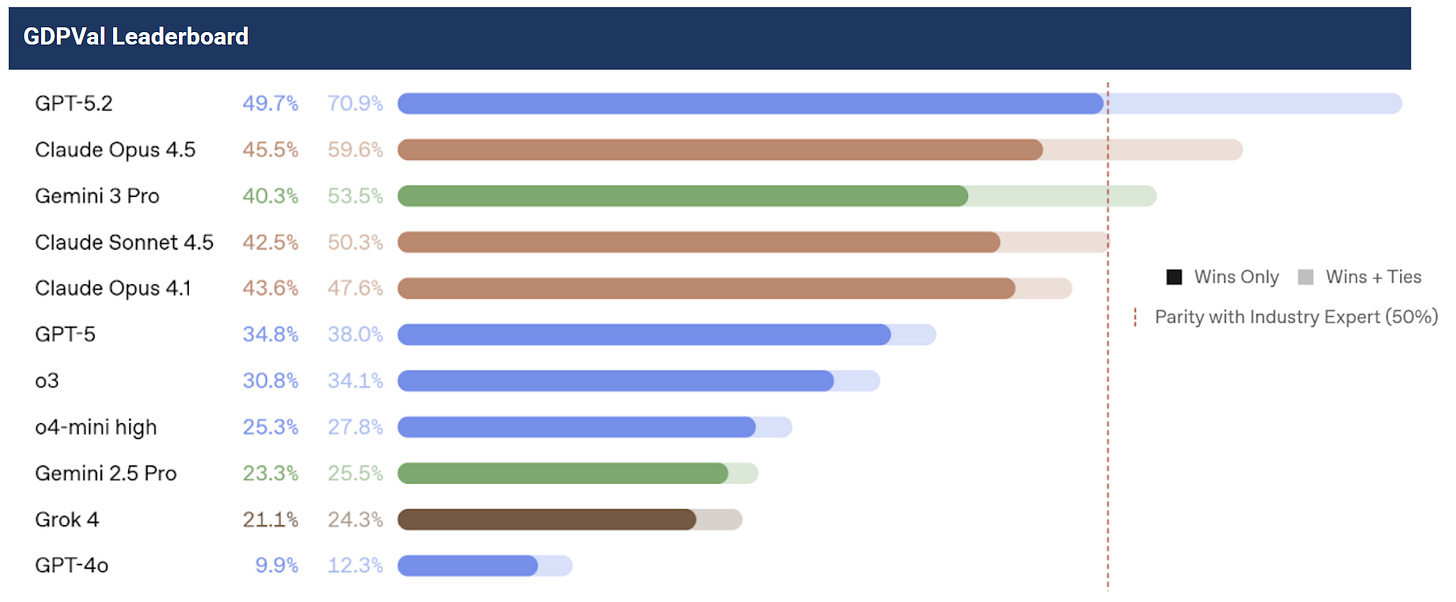

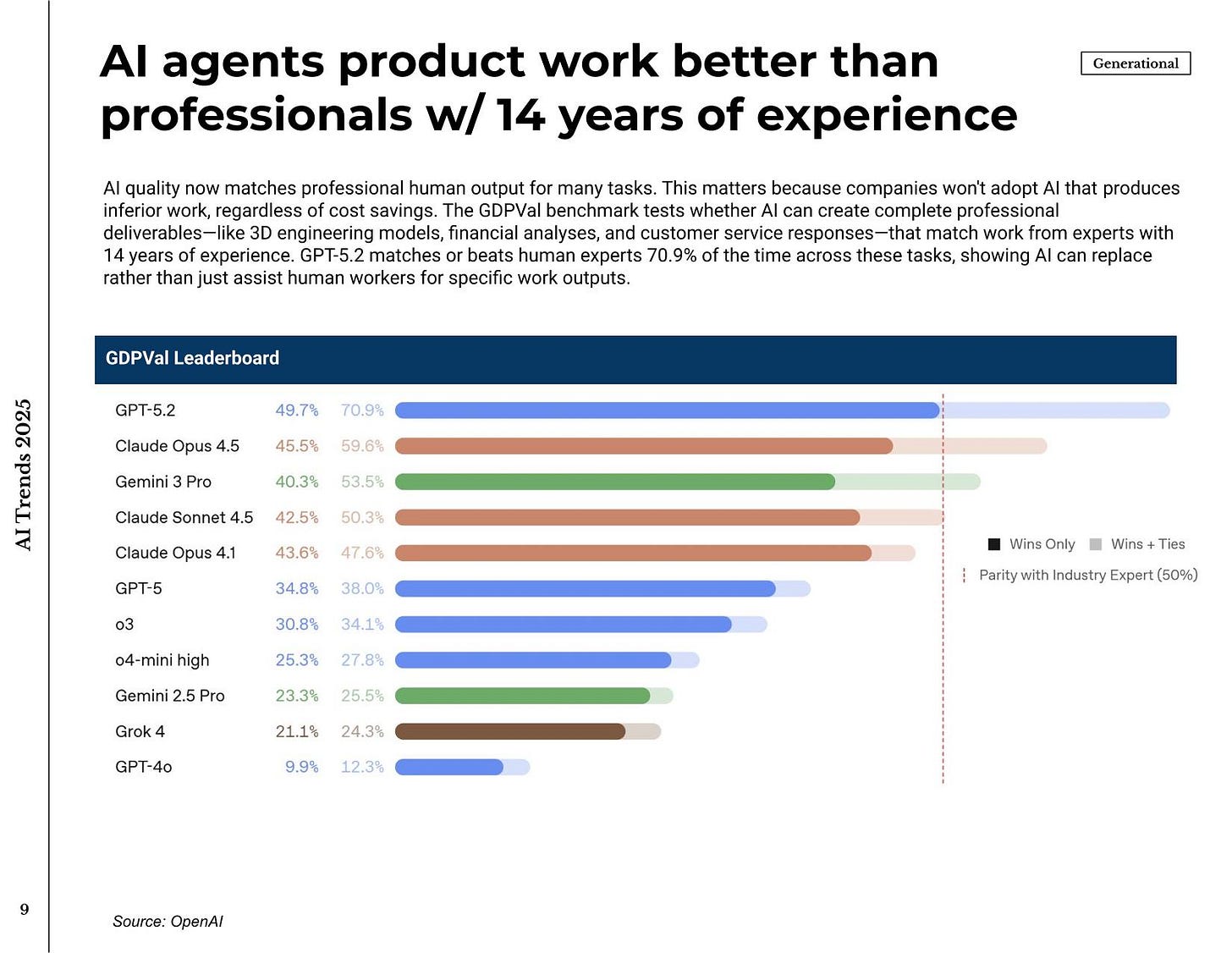

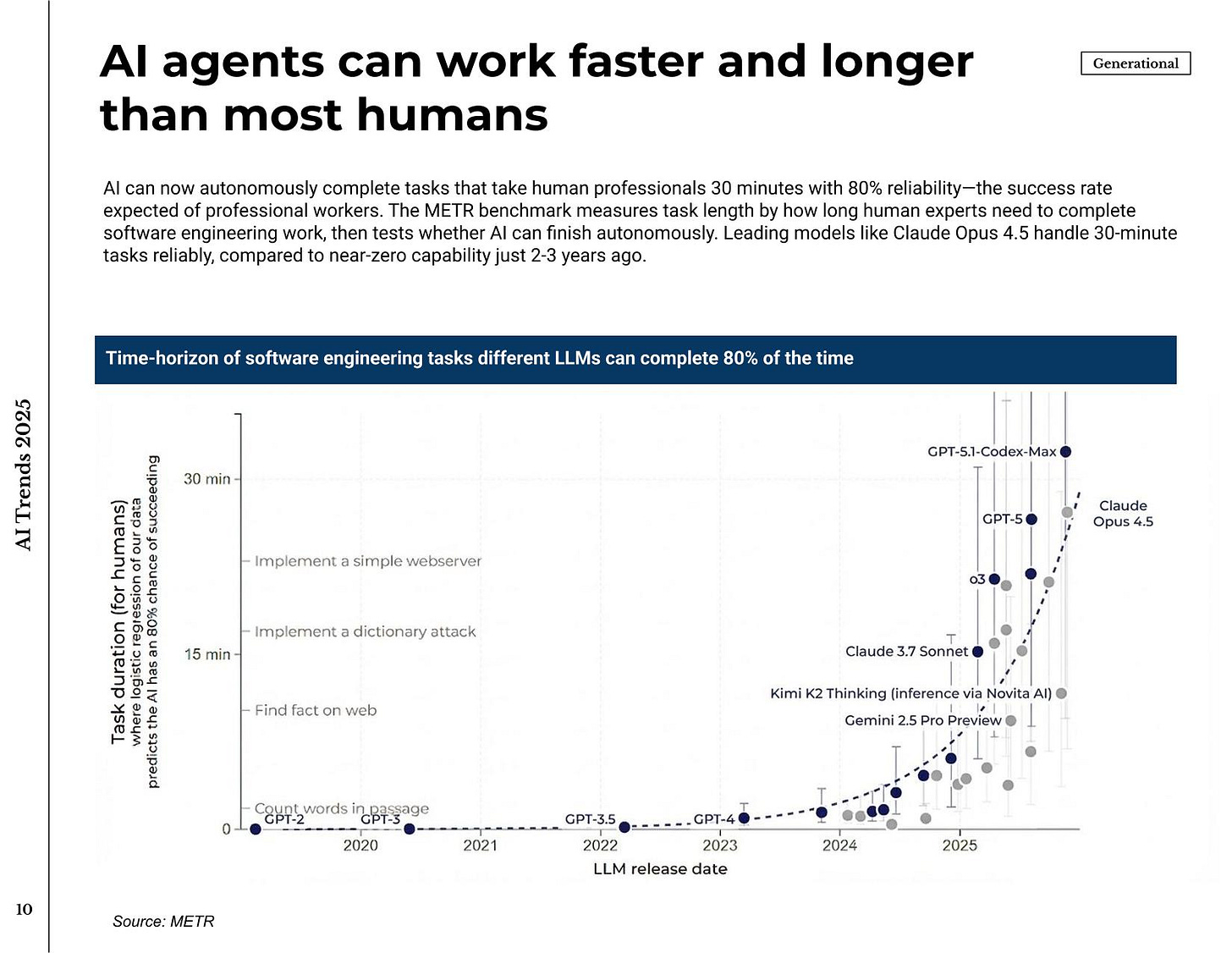

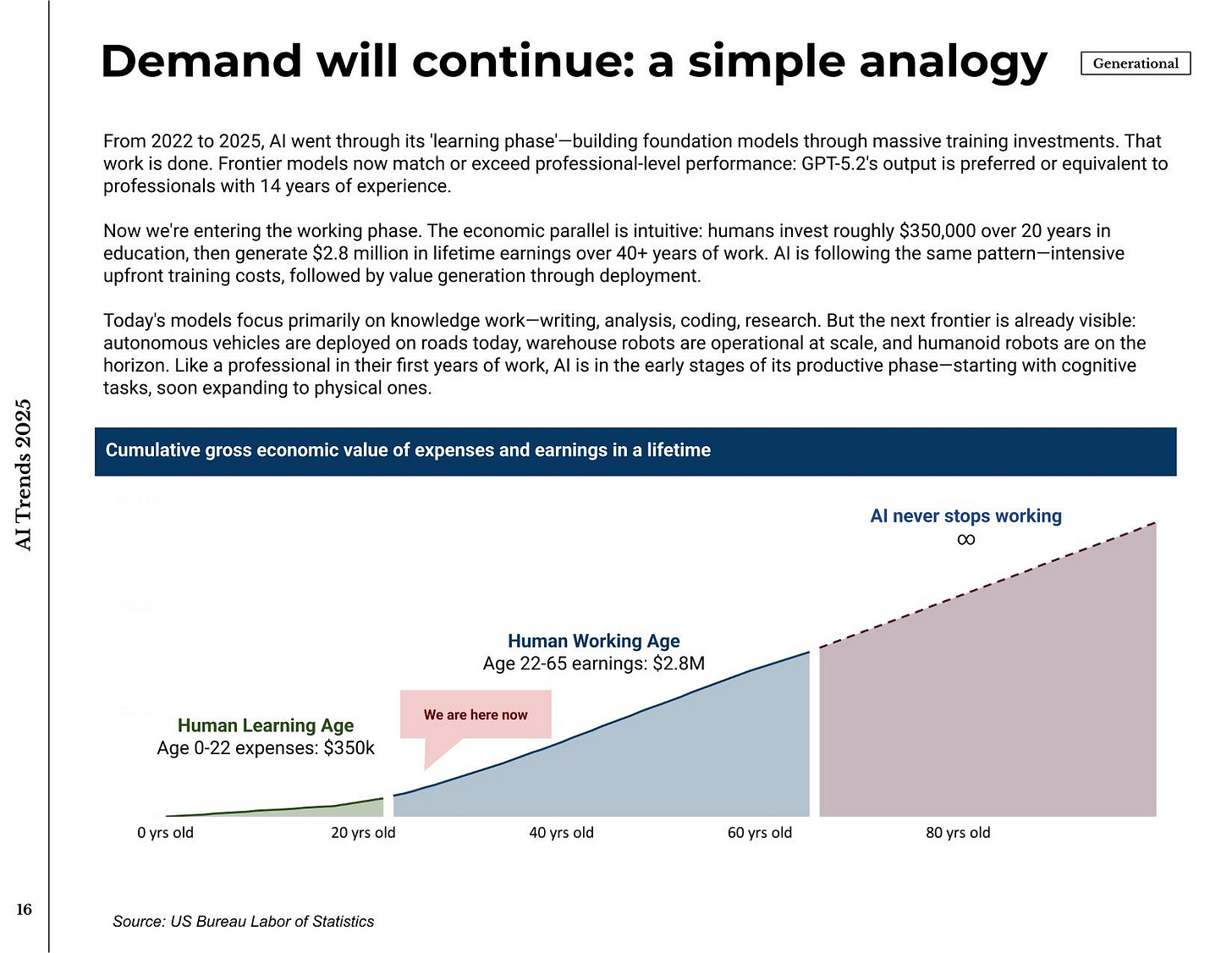

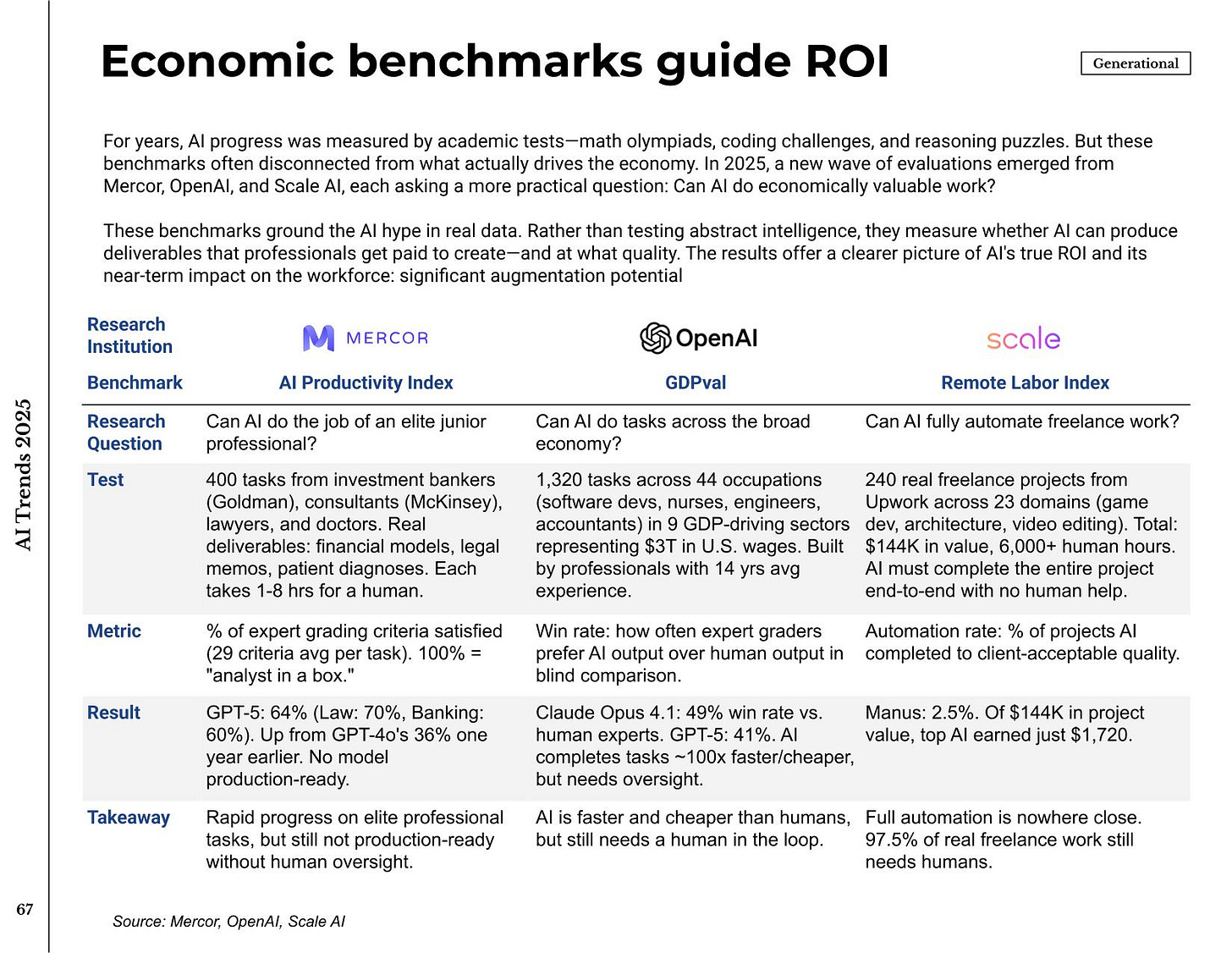

The shift from AI-as-assistant to AI-as-worker is now visible in benchmarks. The GDPWell benchmark tests whether AI can generate professional-grade deliverables – things like 3D engineering models and financial analysis. Latest results: GPT-5.2 matches or outperforms human experts (with an average of 14 years of experience) in 70.9% of cases.

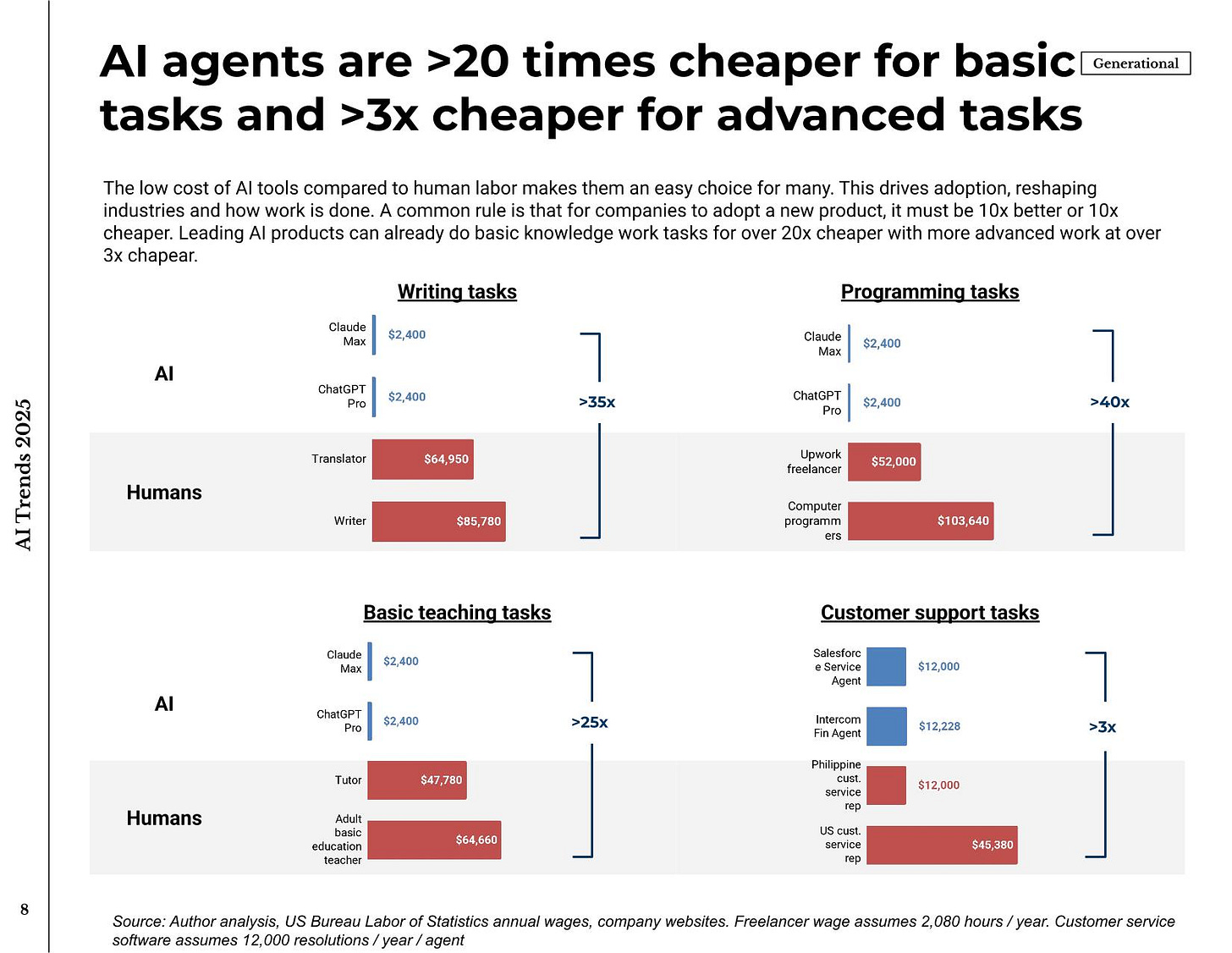

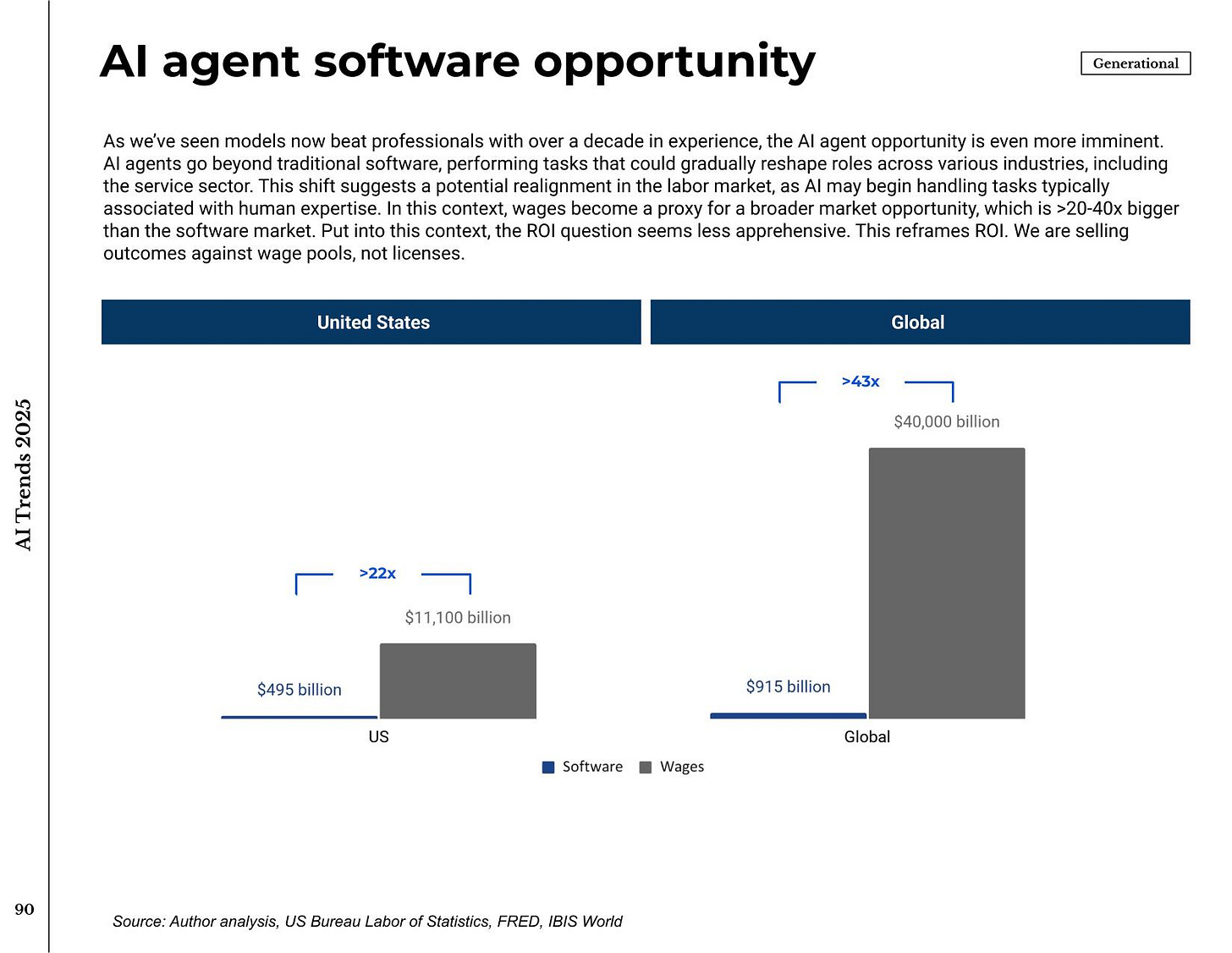

The economics are baseless. For a range of cognitive tasks, AI agents are now more than 20 times cheaper for basic tasks and more than 3 times cheaper for advanced tasks like programming and creative writing.

This is already impacting recruitment:

-

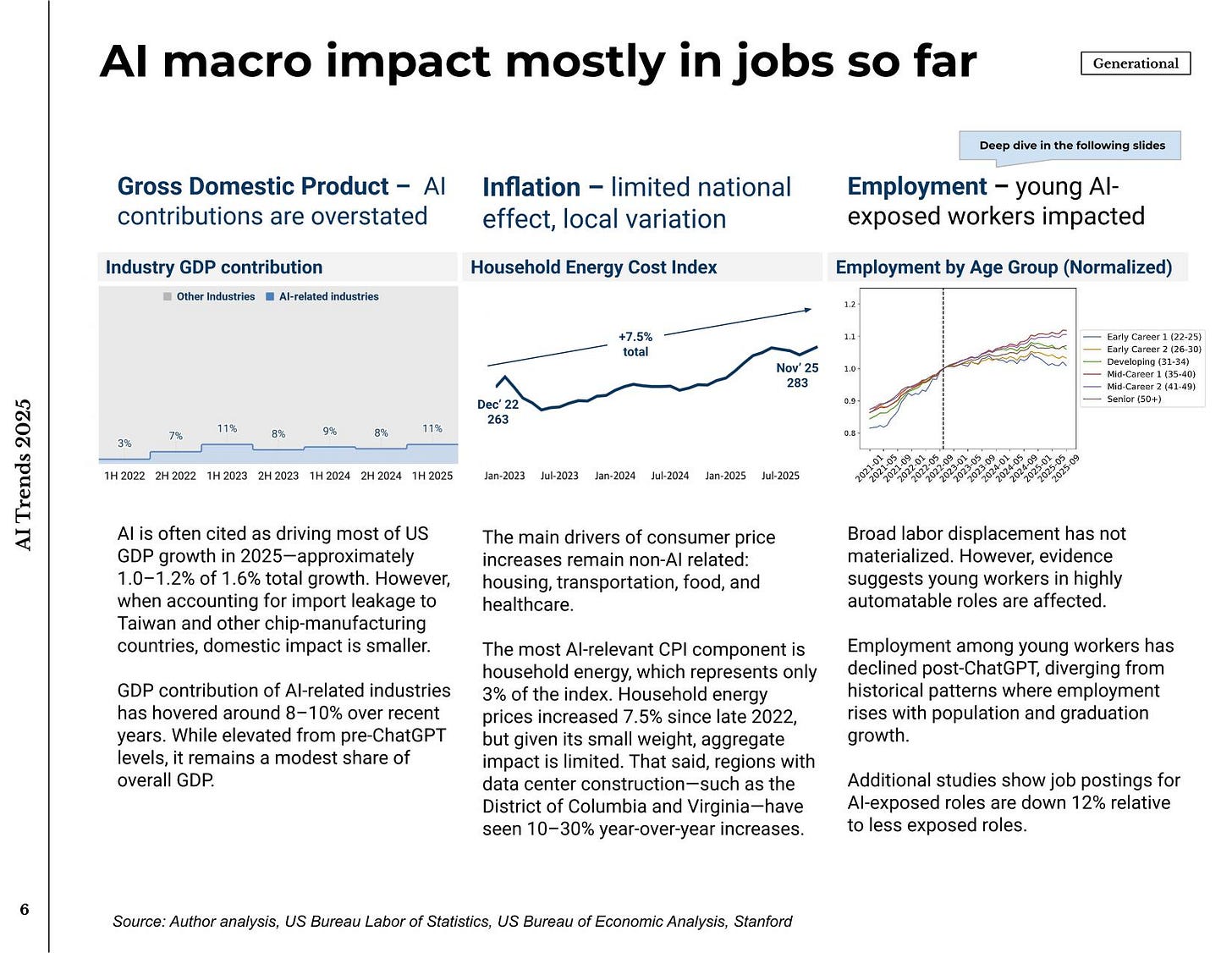

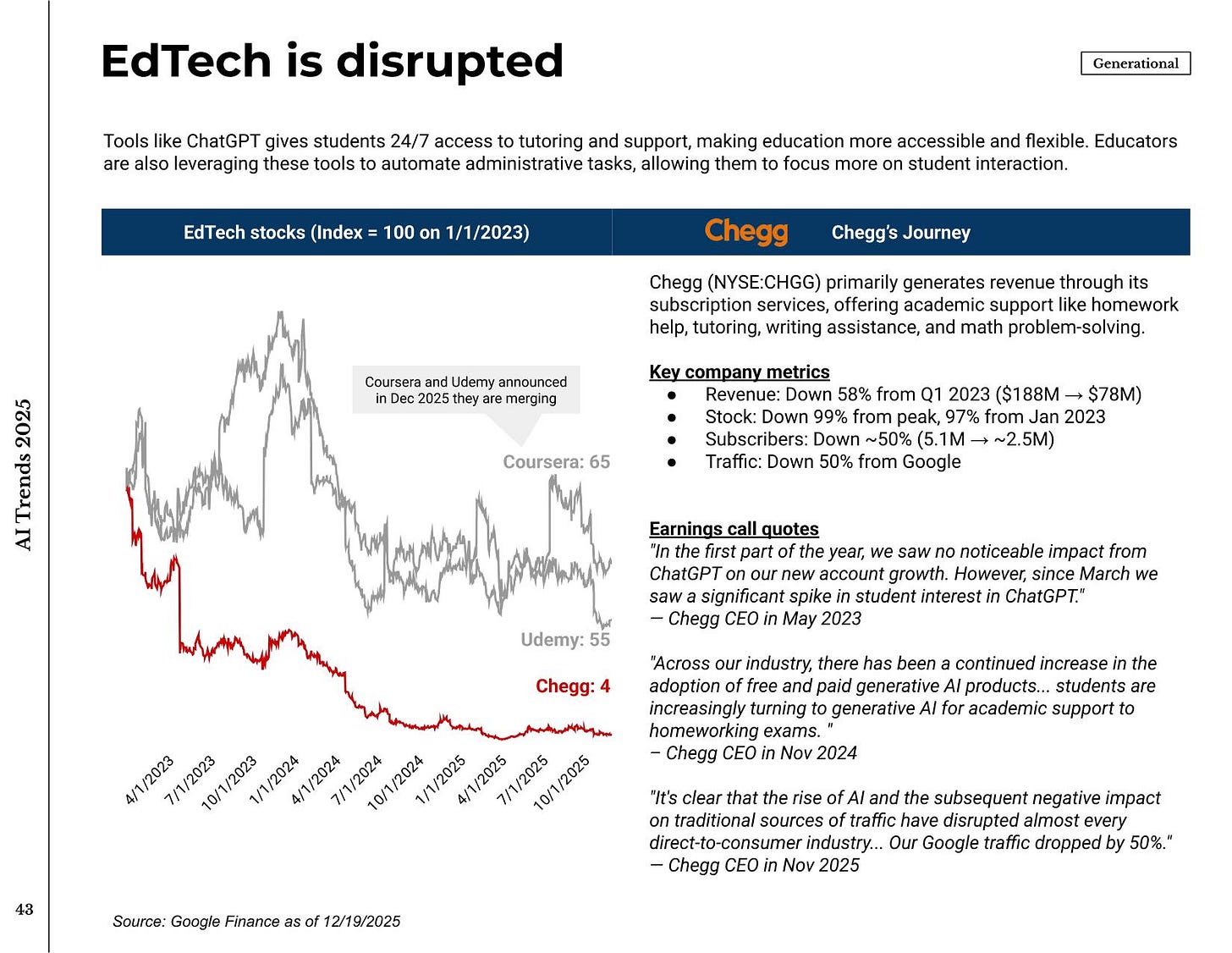

Employment of workers aged 22-25 in highly exposed roles (software development, customer service) has declined sharply

-

Job postings for AI-exposed roles decreased by 12% compared to less exposed roles

-

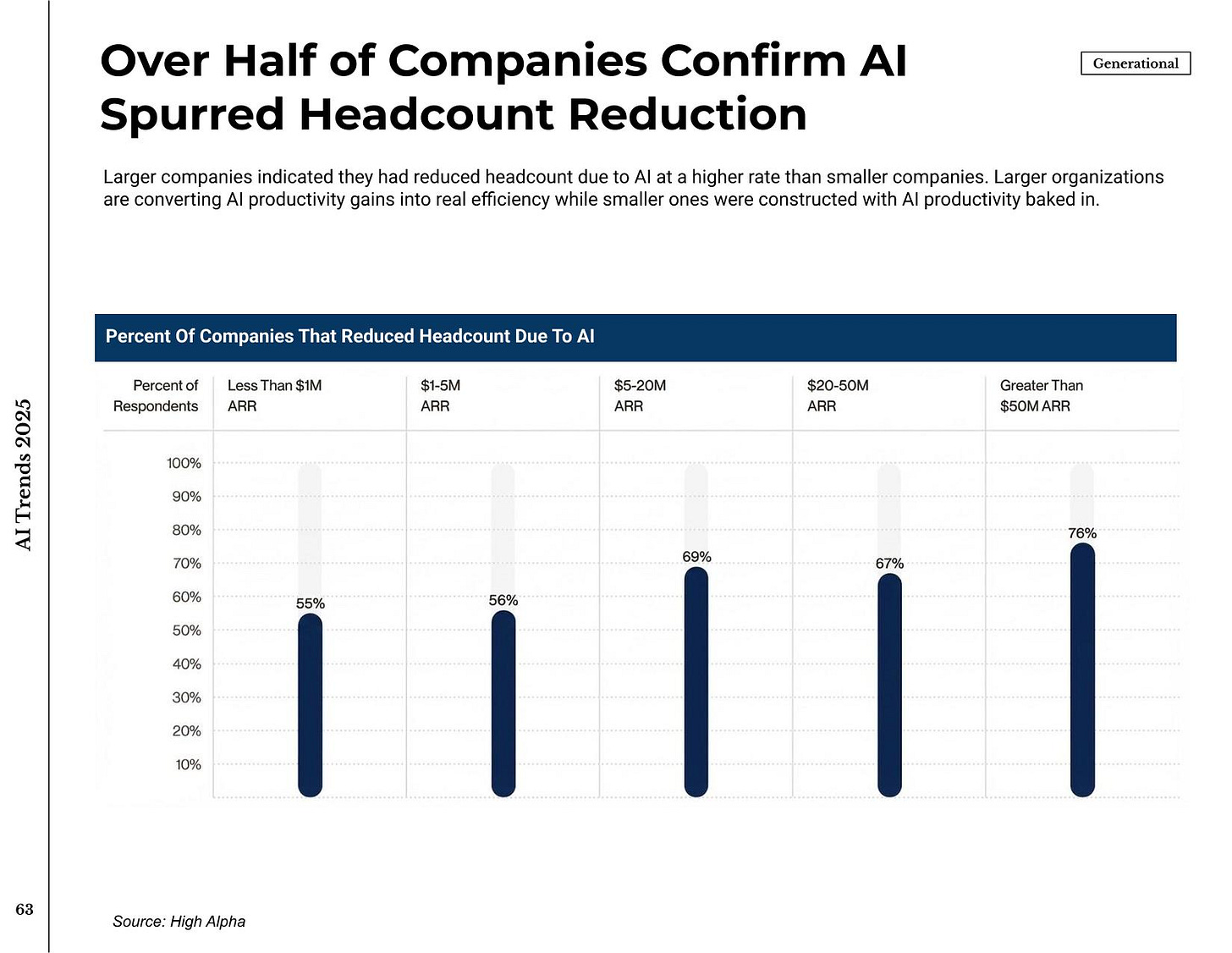

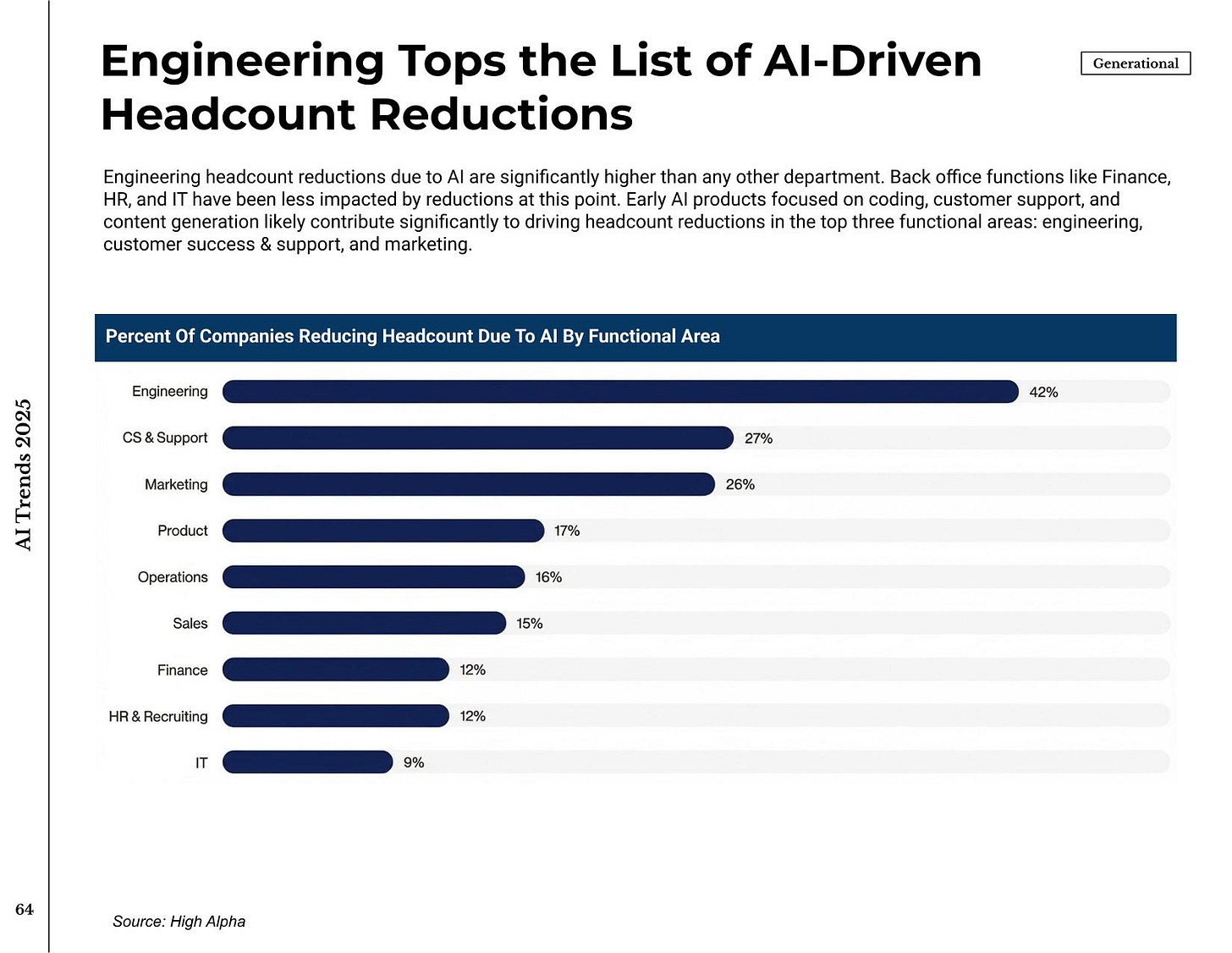

When surveyed, companies report a decline in the number of AI-powered employees in engineering (42%), CS and support (27%), and marketing (26%).

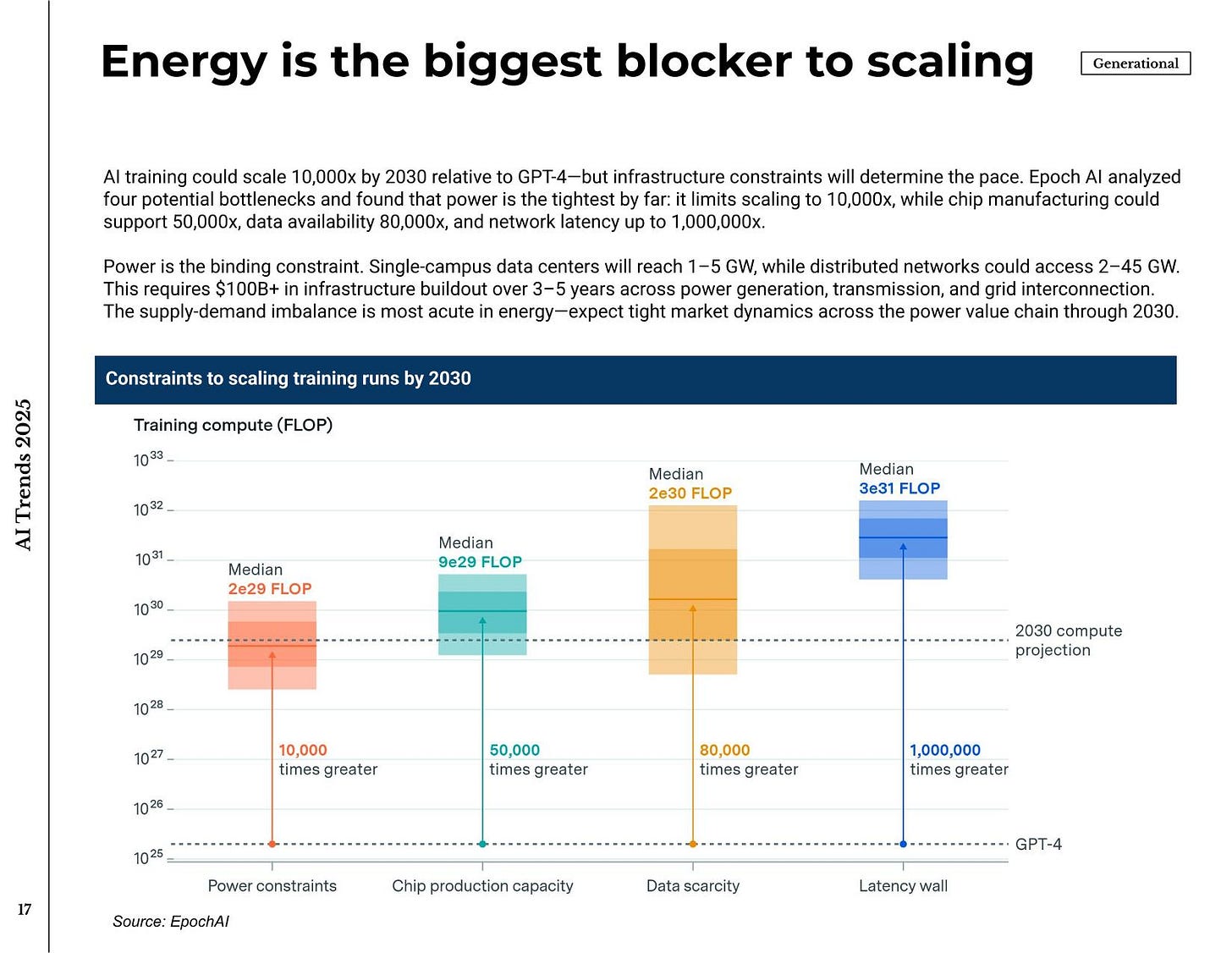

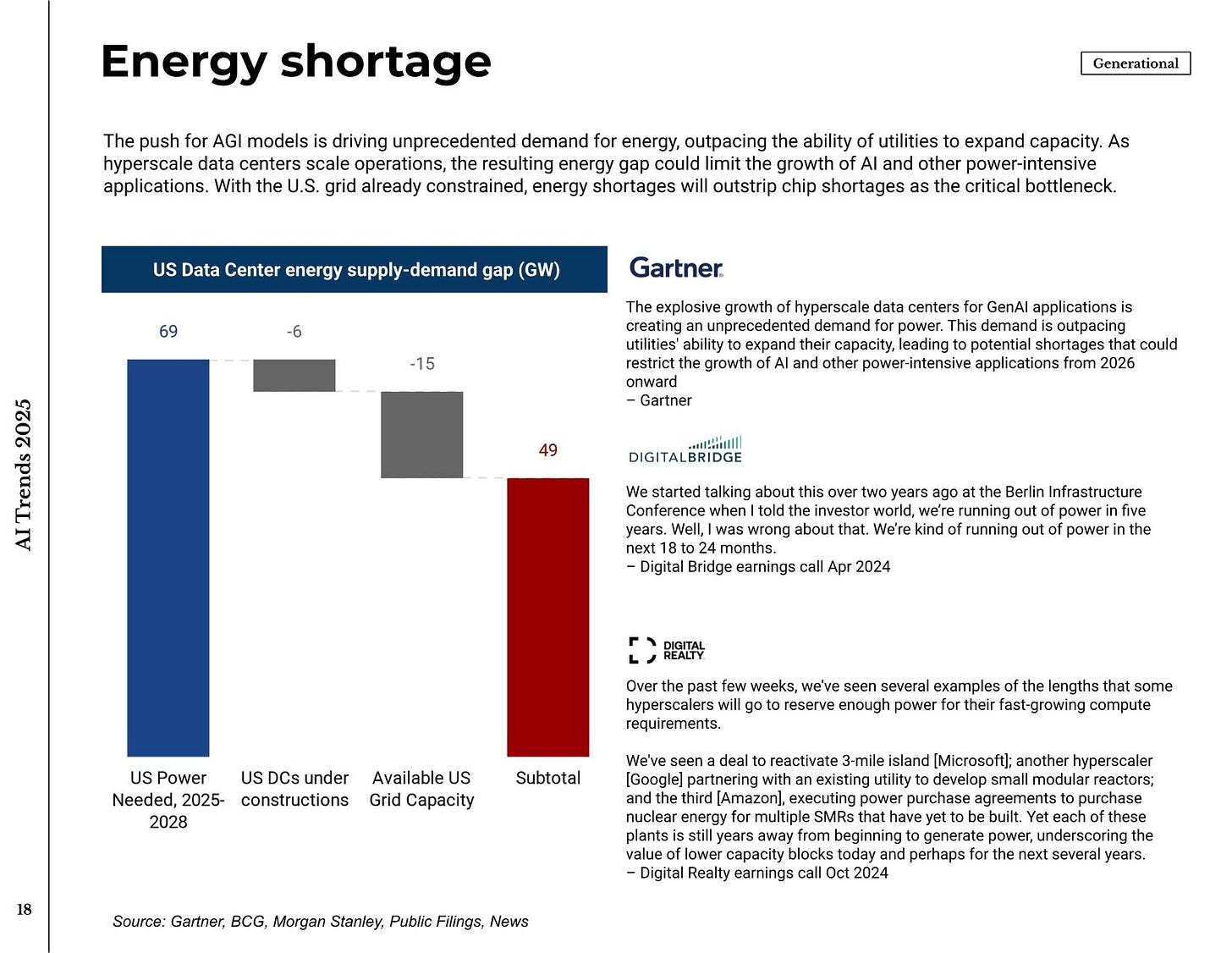

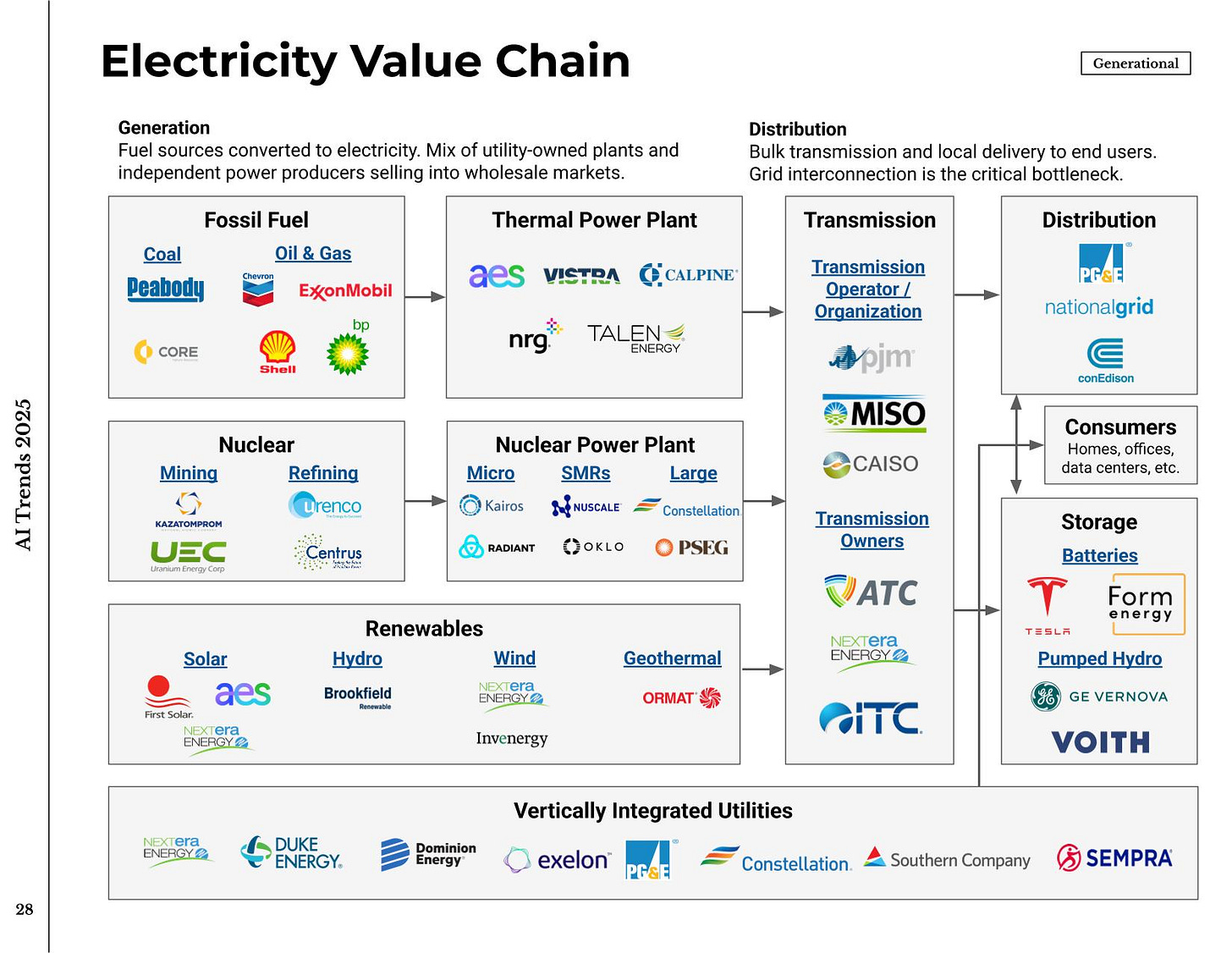

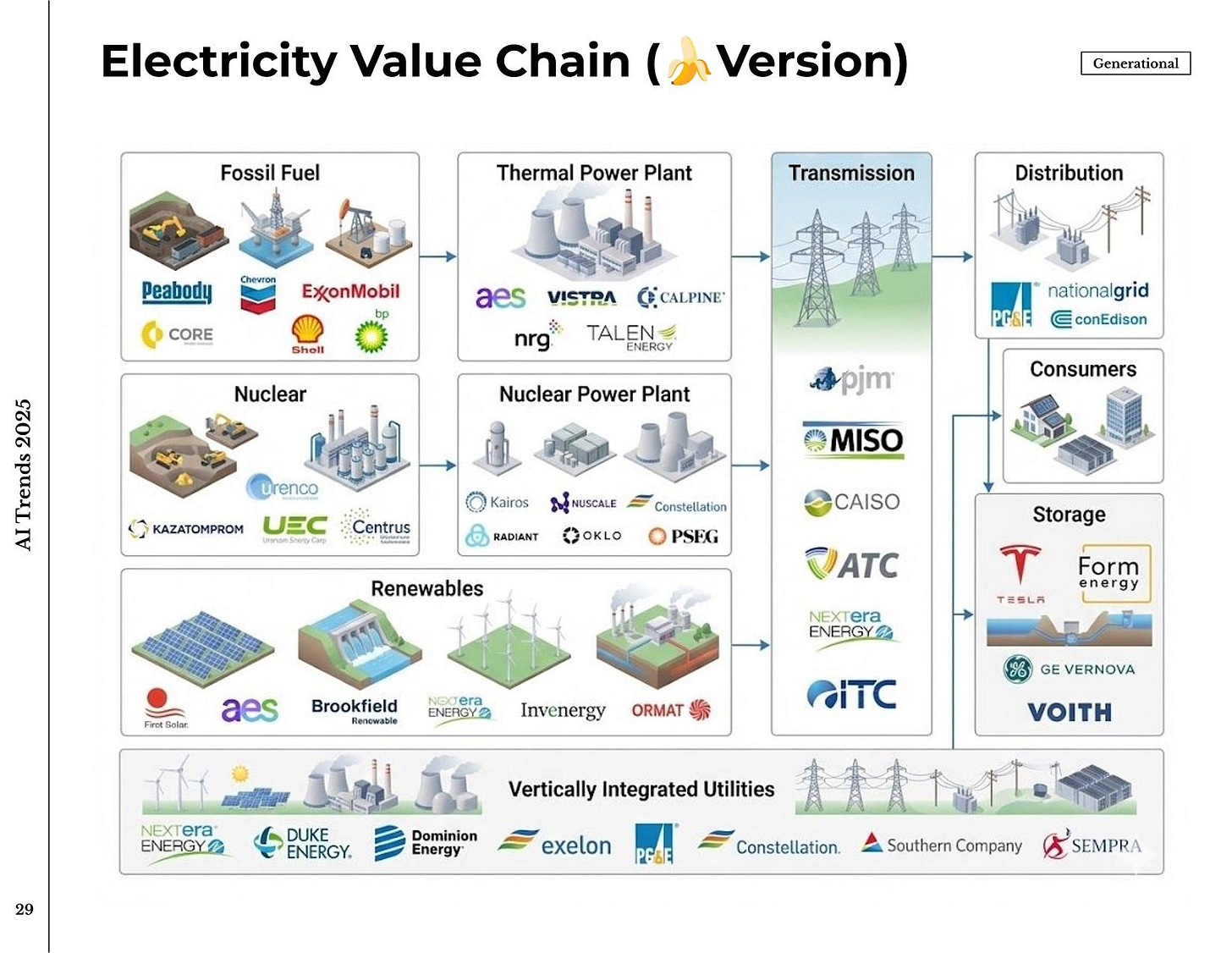

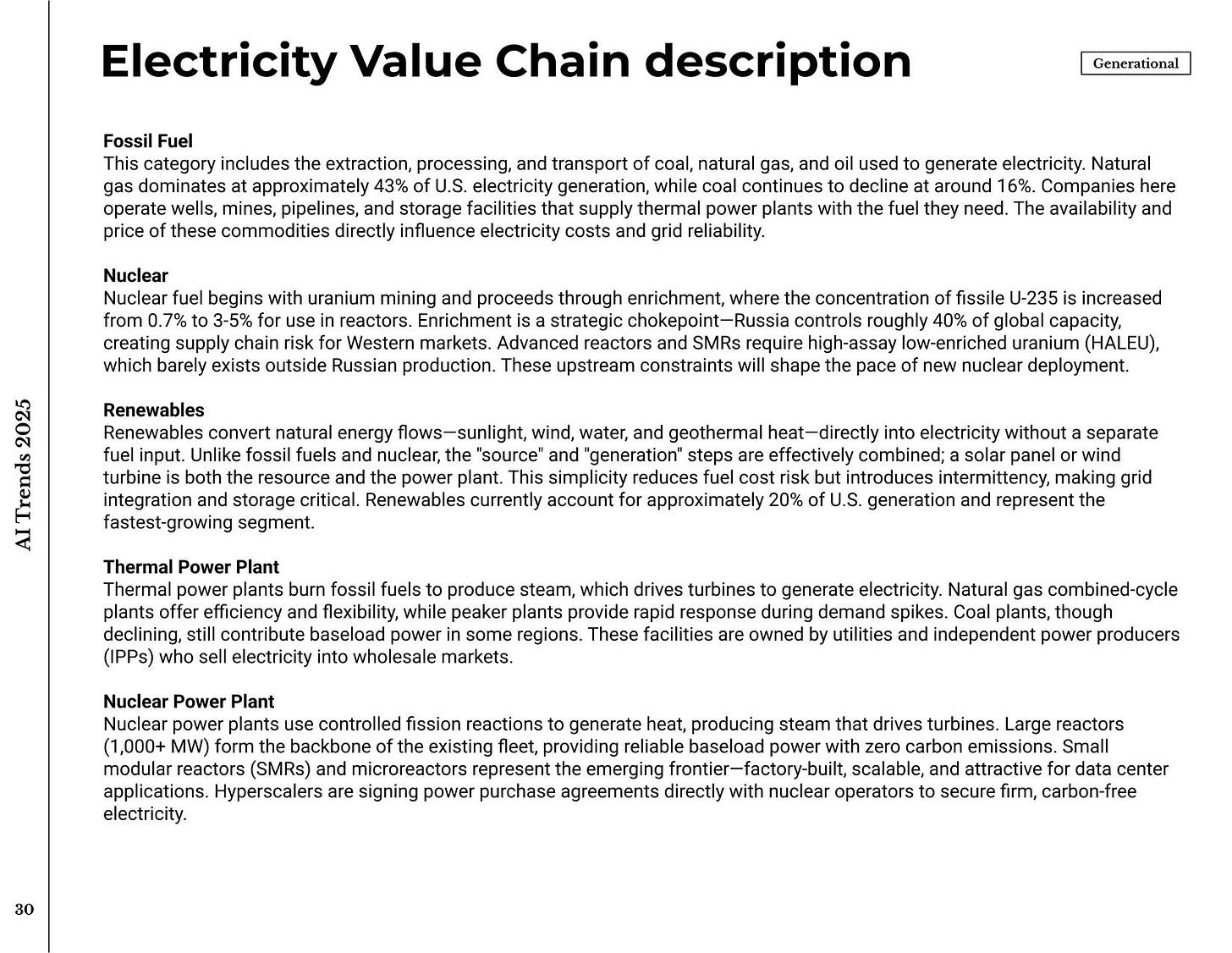

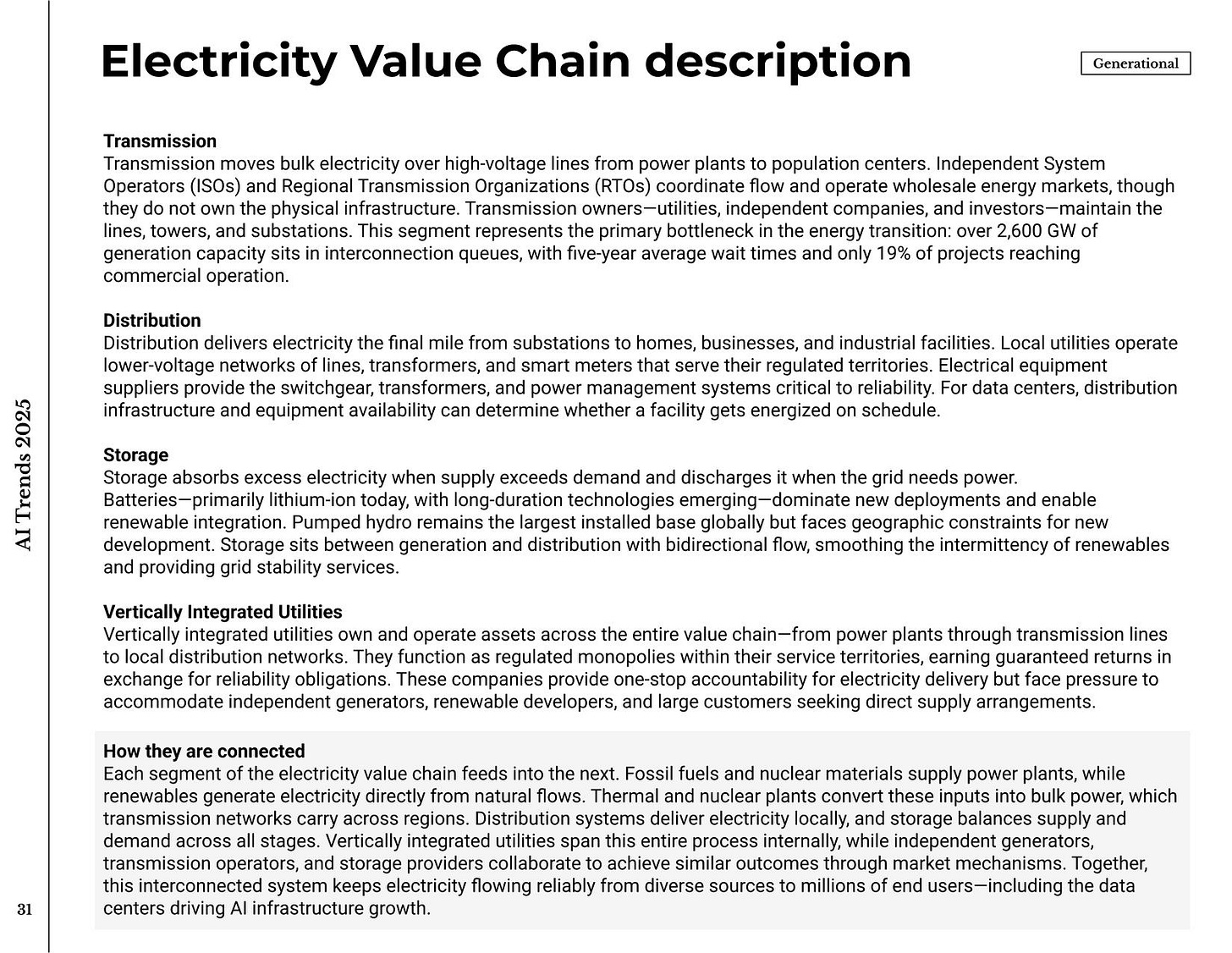

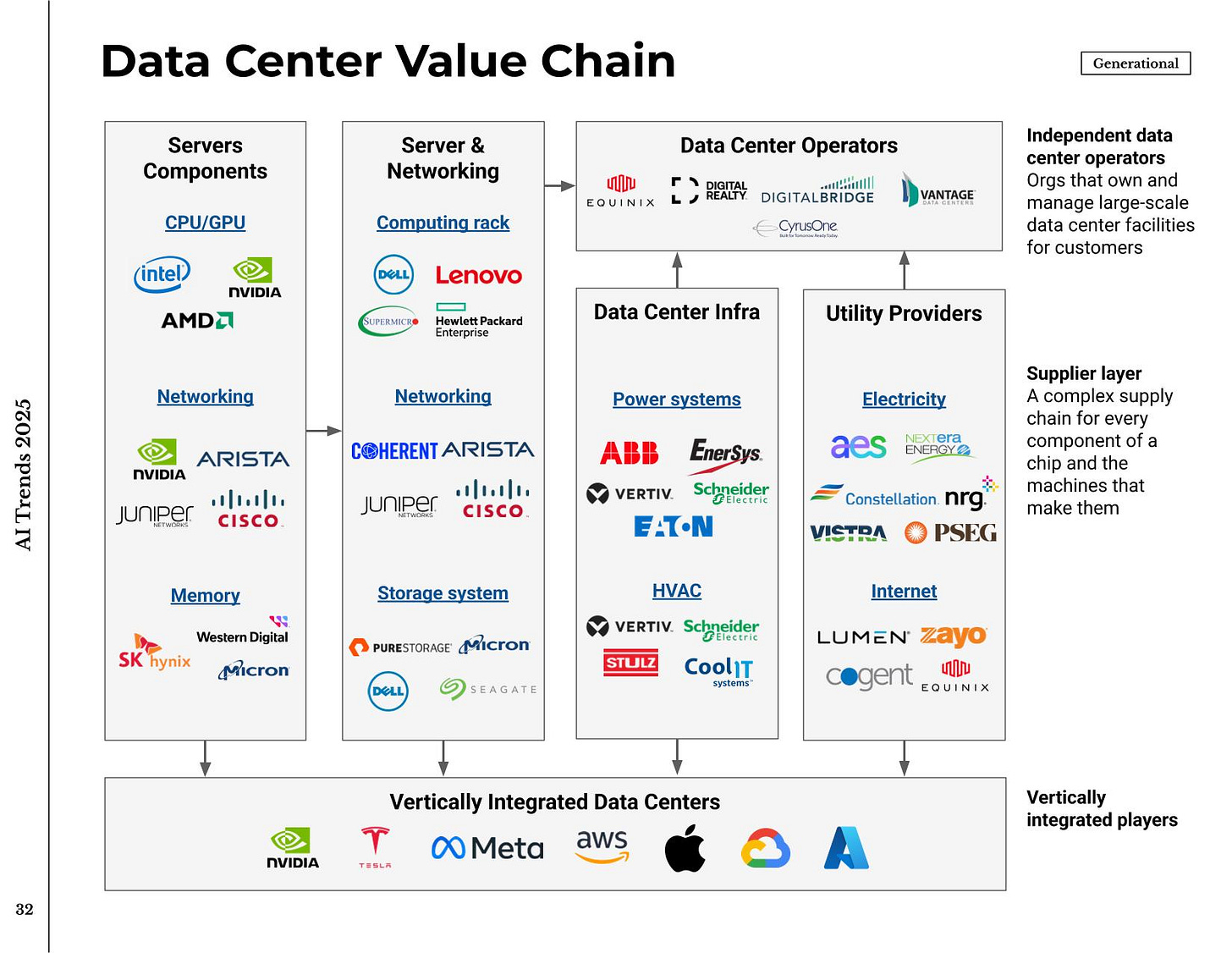

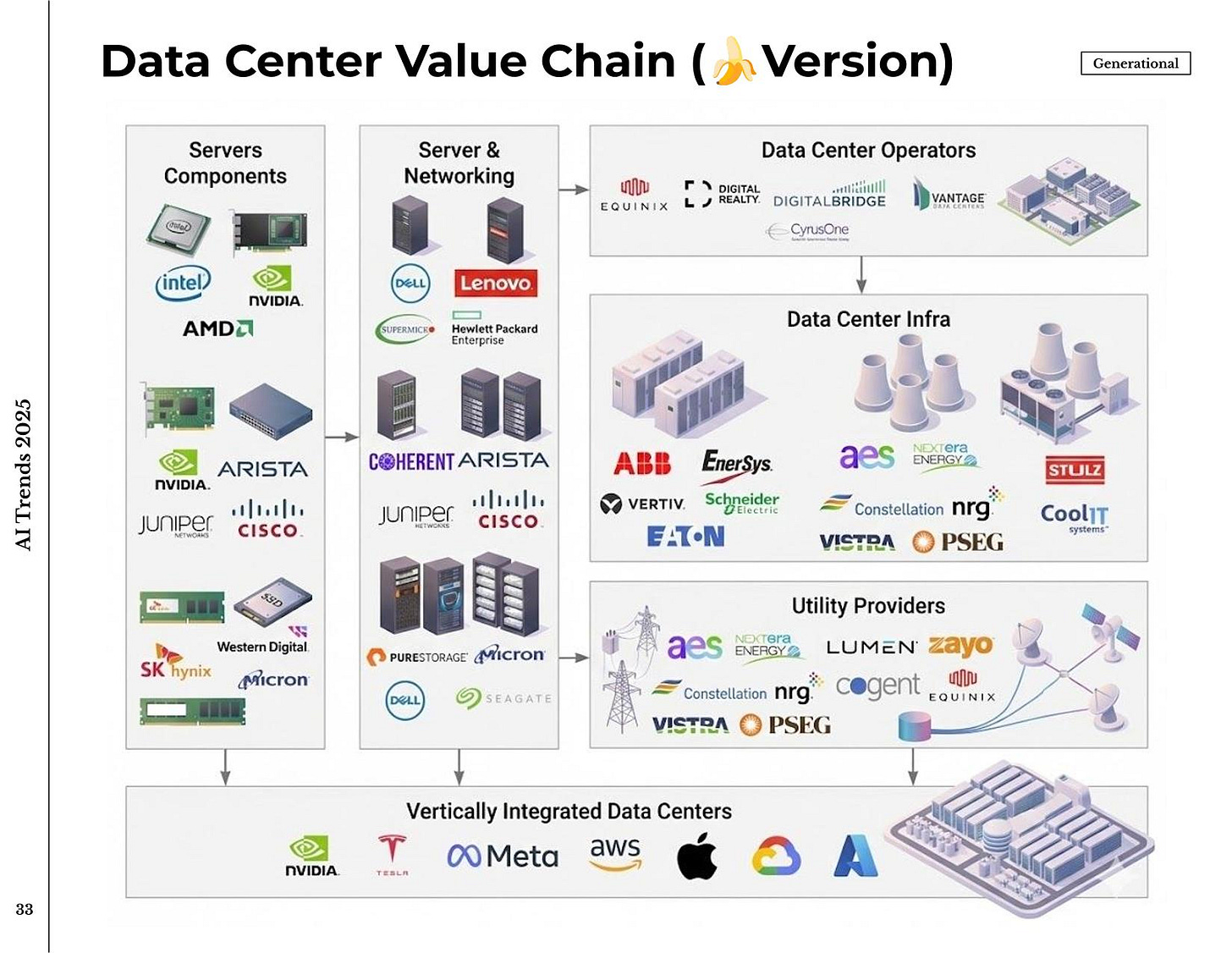

For all the focus on algorithms and chips, power is emerging as the binding constraint.

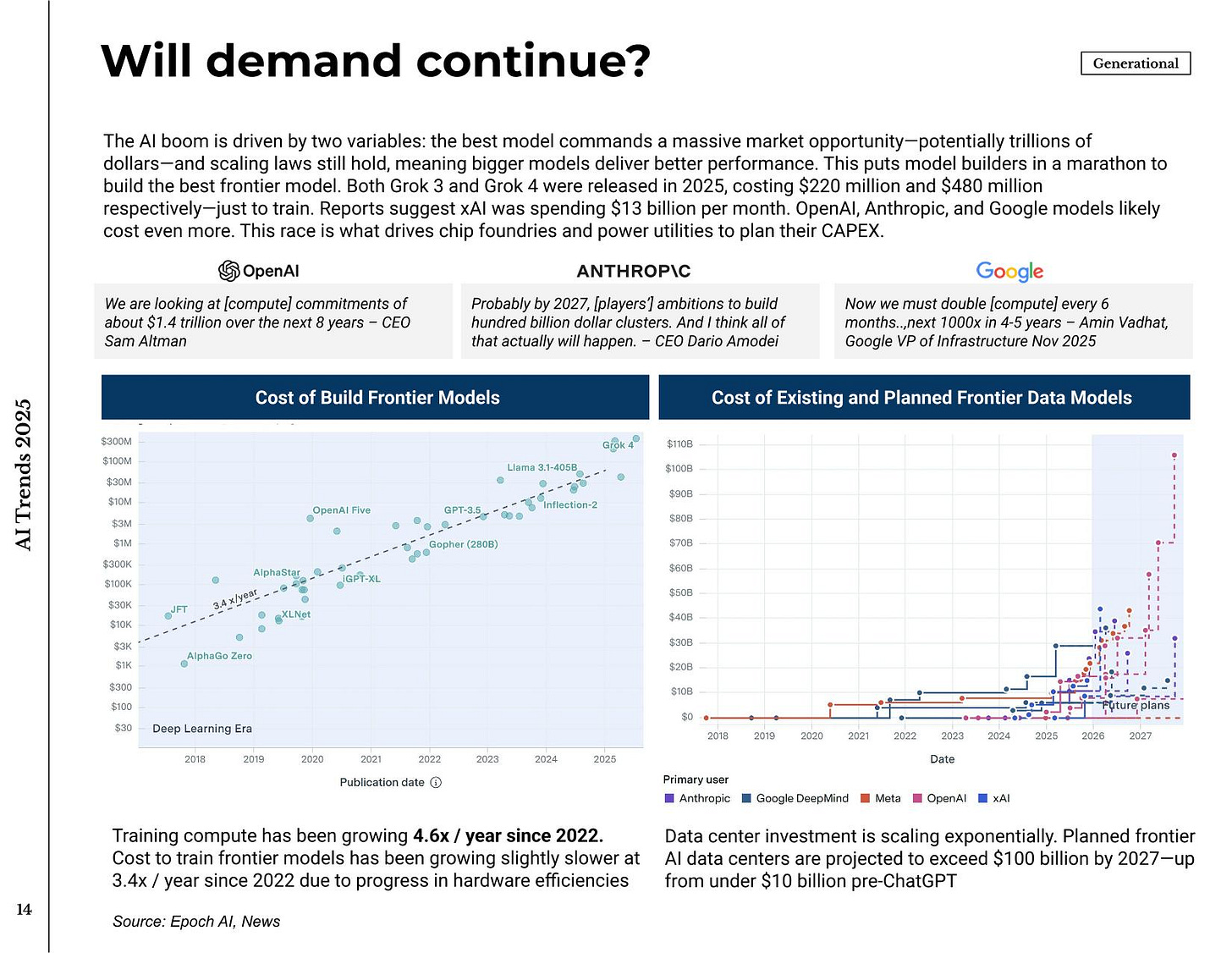

Epoch AI found that while chip manufacturing could theoretically support an 80,000-fold increase in training calculations by 2030, power constraints limit this to about 10,000-fold. Energy is the tightest limit by a wide margin.

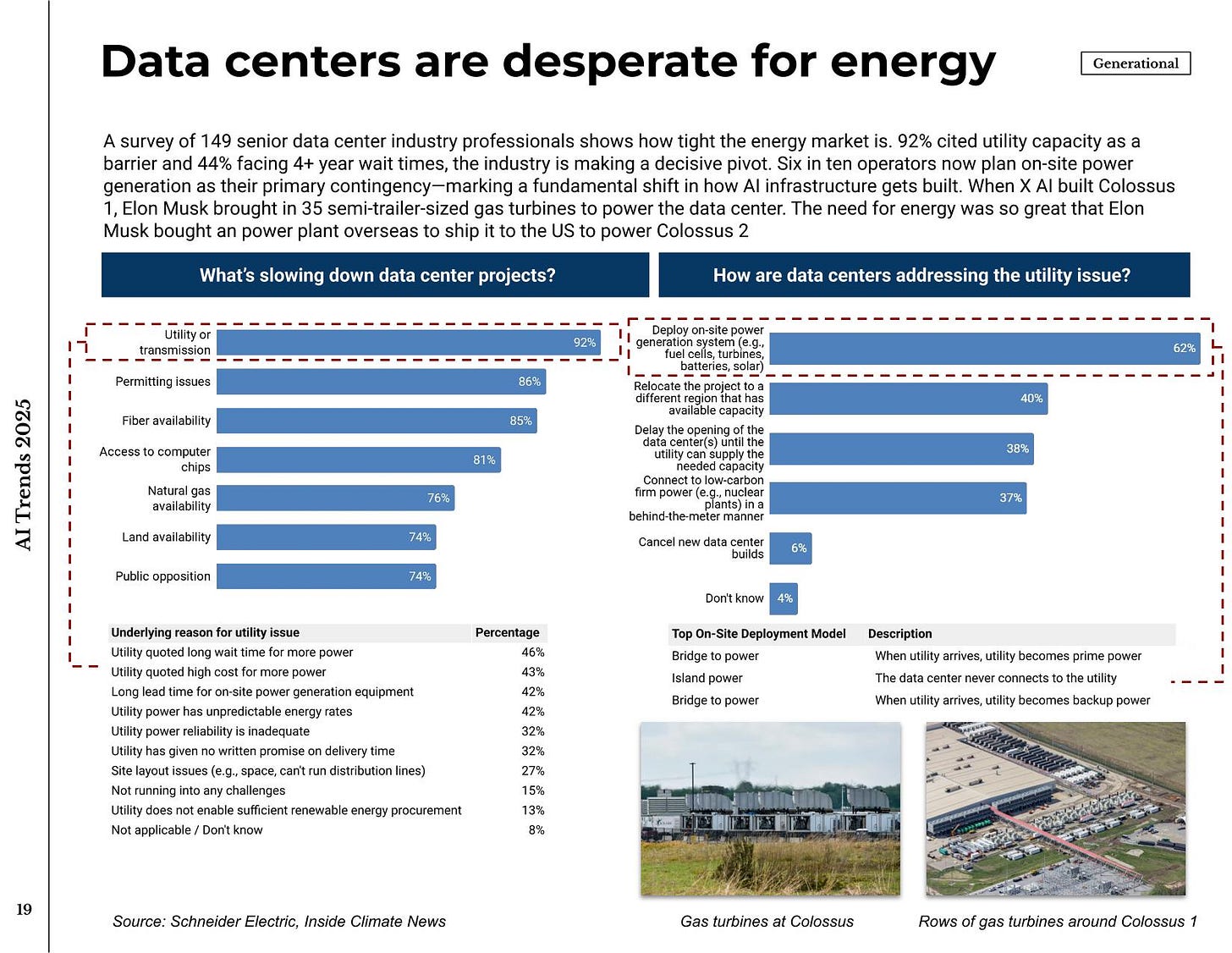

This is not just theoretical. 92% of senior data center professionals now cite utility power availability as a major barrier. 44% face a wait of four years or more for a grid connection. Some are building their own on-site generation—gas turbines, even small modular nuclear reactors.

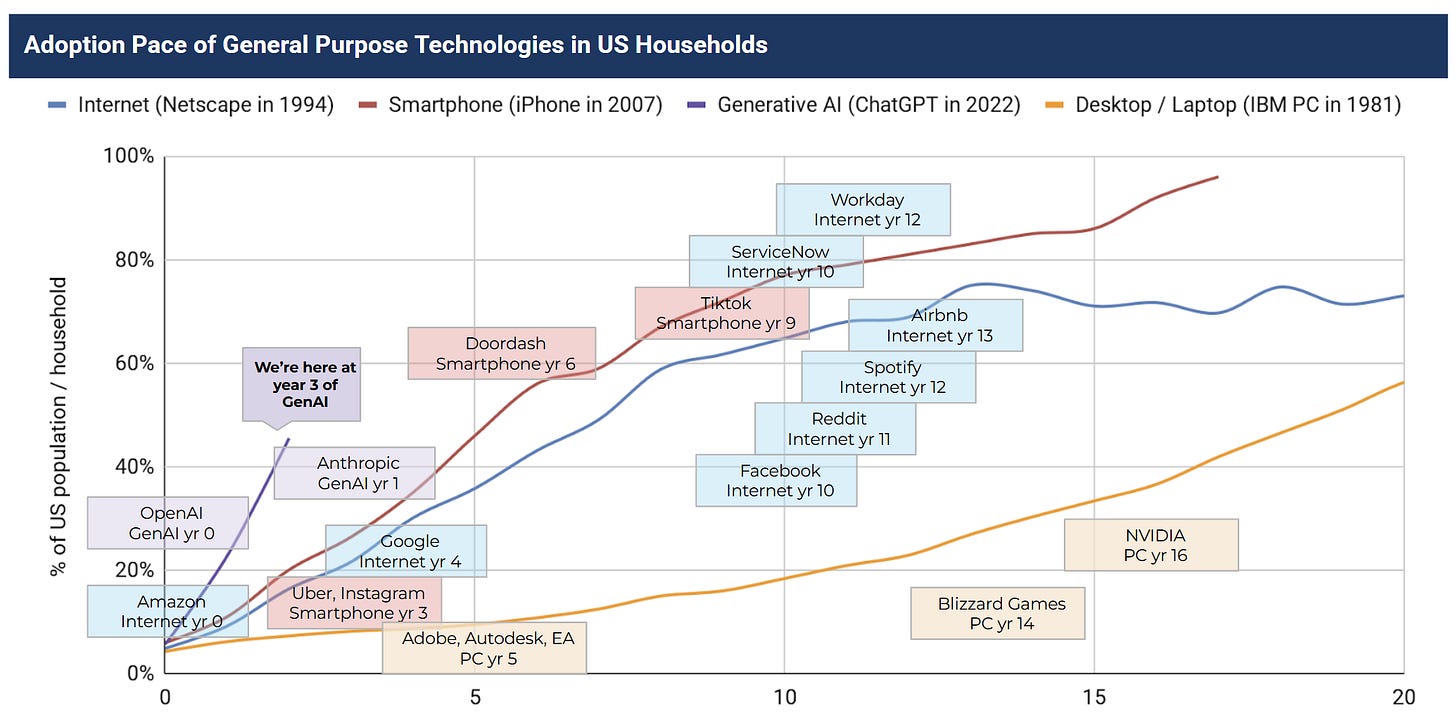

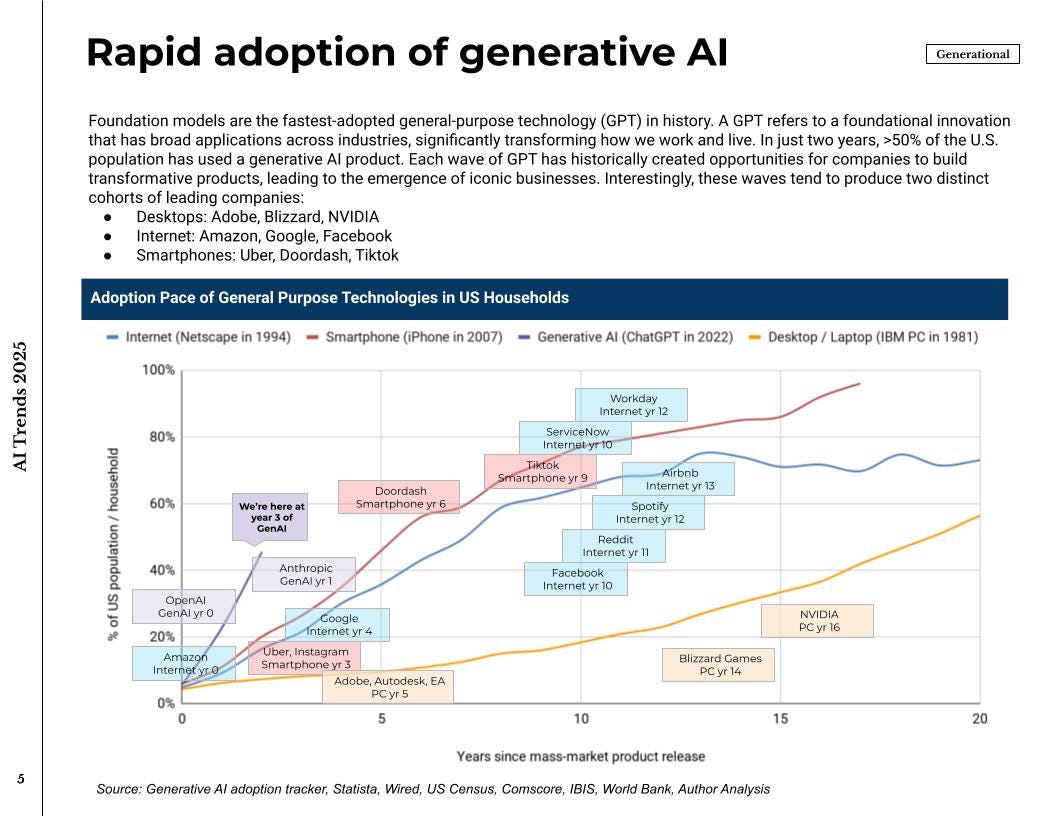

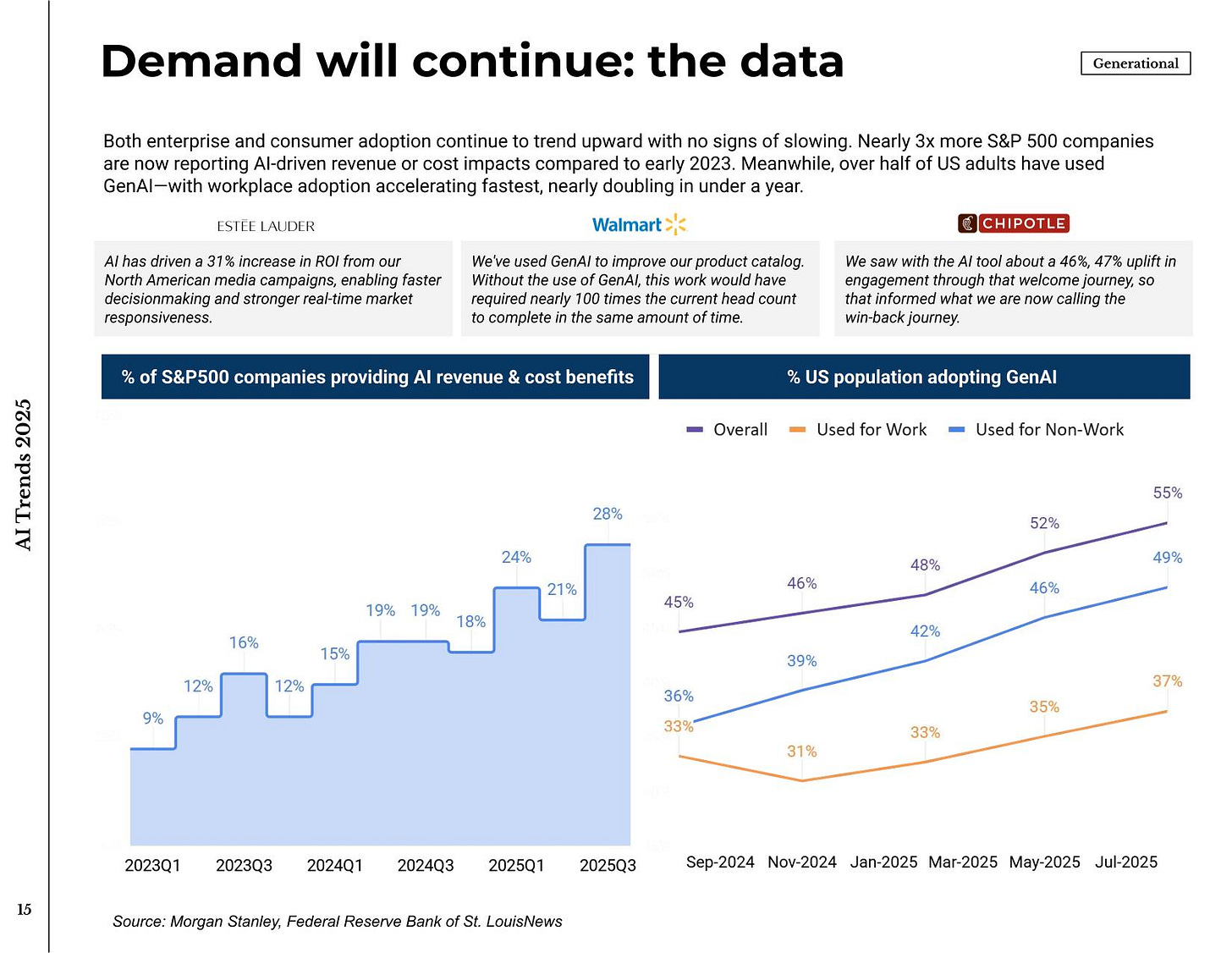

By mid-2025, 55% of US adults will have used a generative AI product. This is a faster adoption curve than the Internet or smartphones.

Products that run it:

-

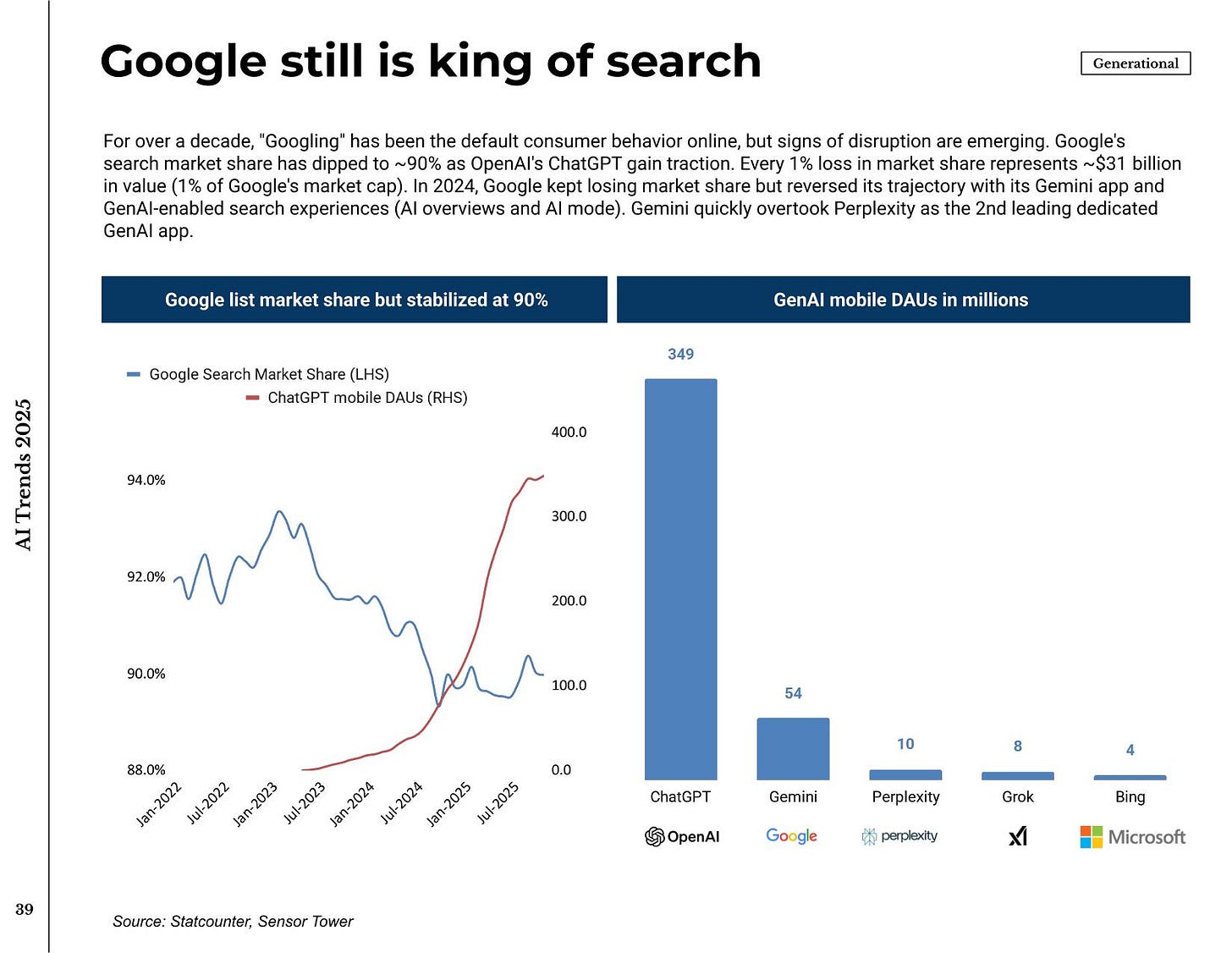

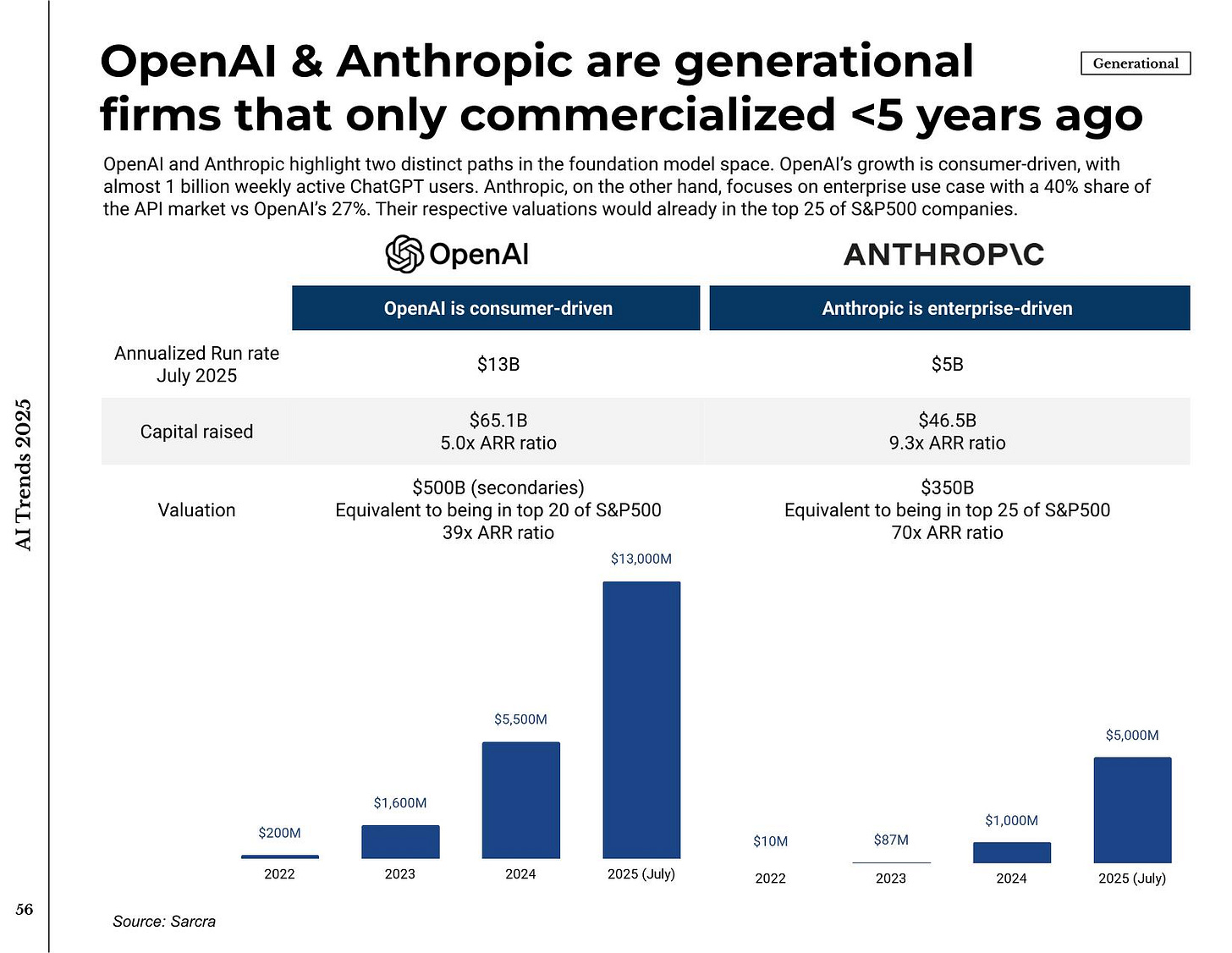

chatgpt:900M weekly active users, >$12B ARR. It has become the default brand for AI, the way Google is for search.

-

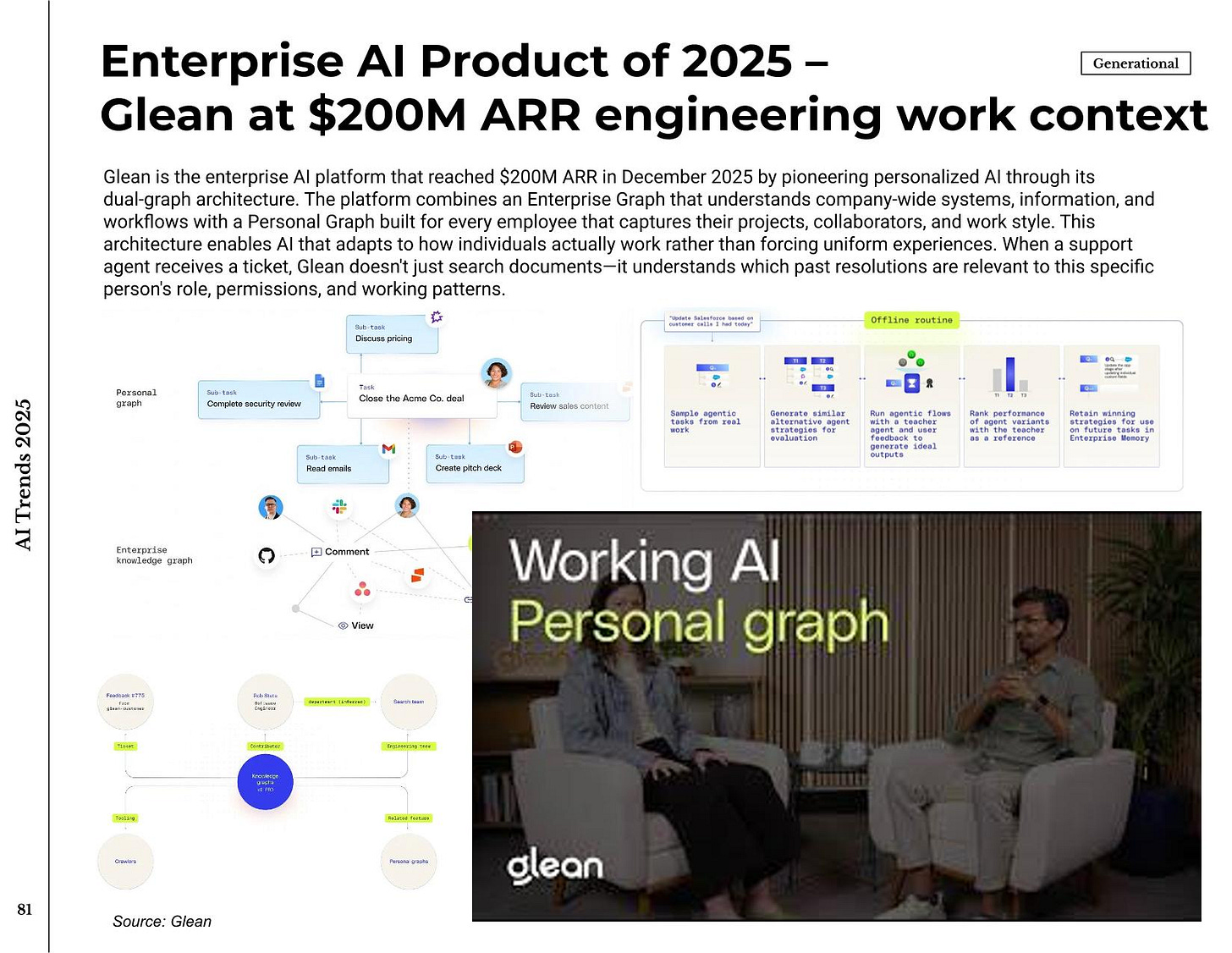

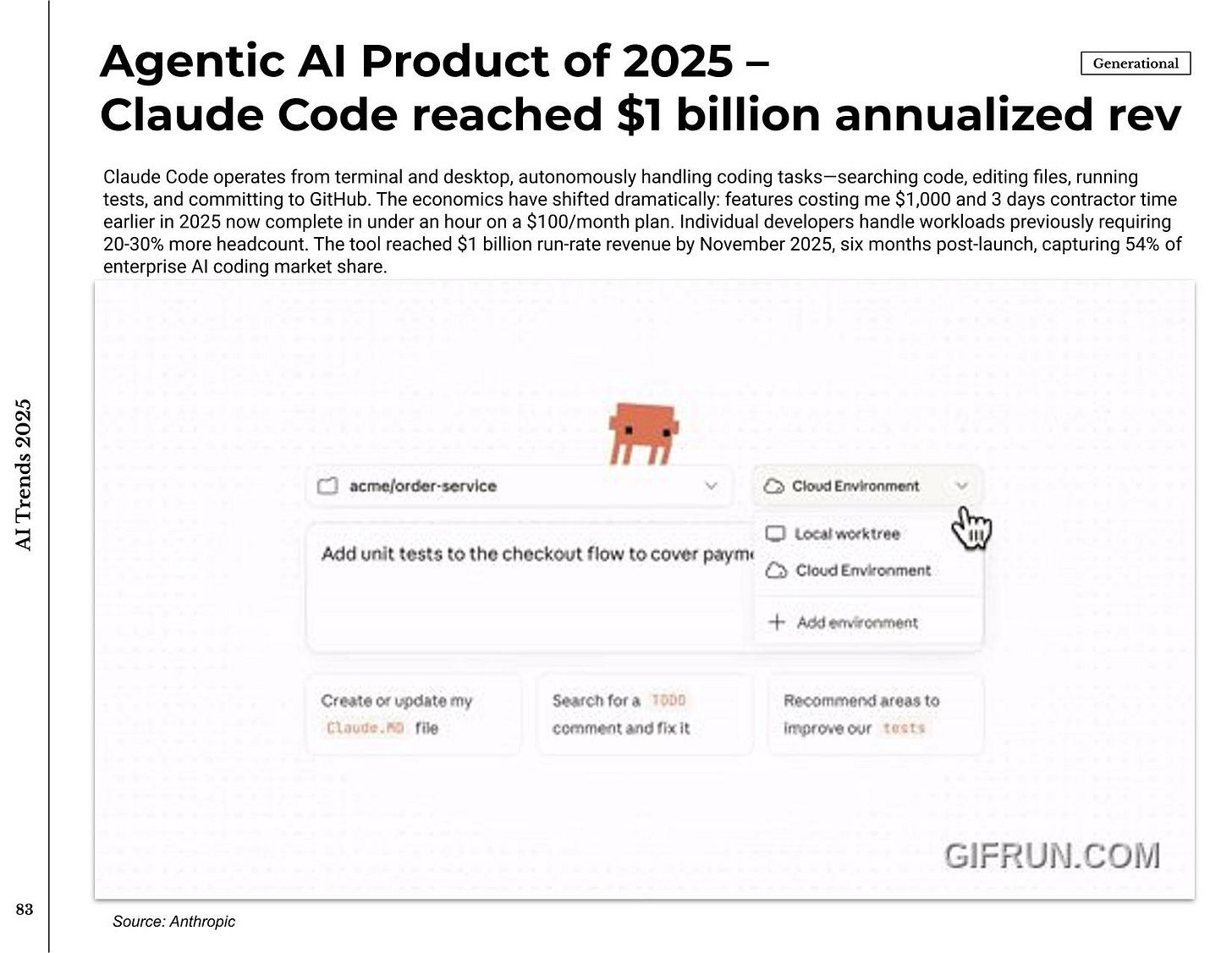

cloud code: $1B revenue run rate six months after launch. This is the clearest commercial evidence that autonomous agents can replace high-value professional work on a large scale.

-

sora 2 and nano banana: High-fidelity video and image creation transformed from novelty to real creative tool for millions of users.

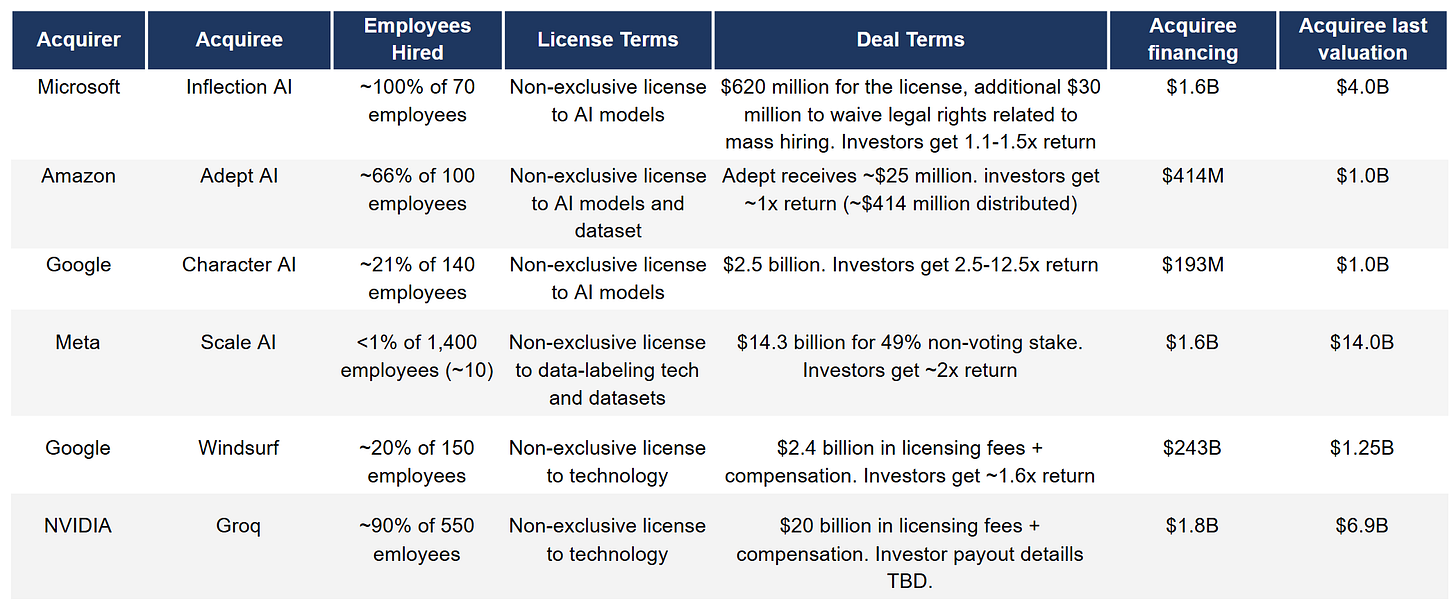

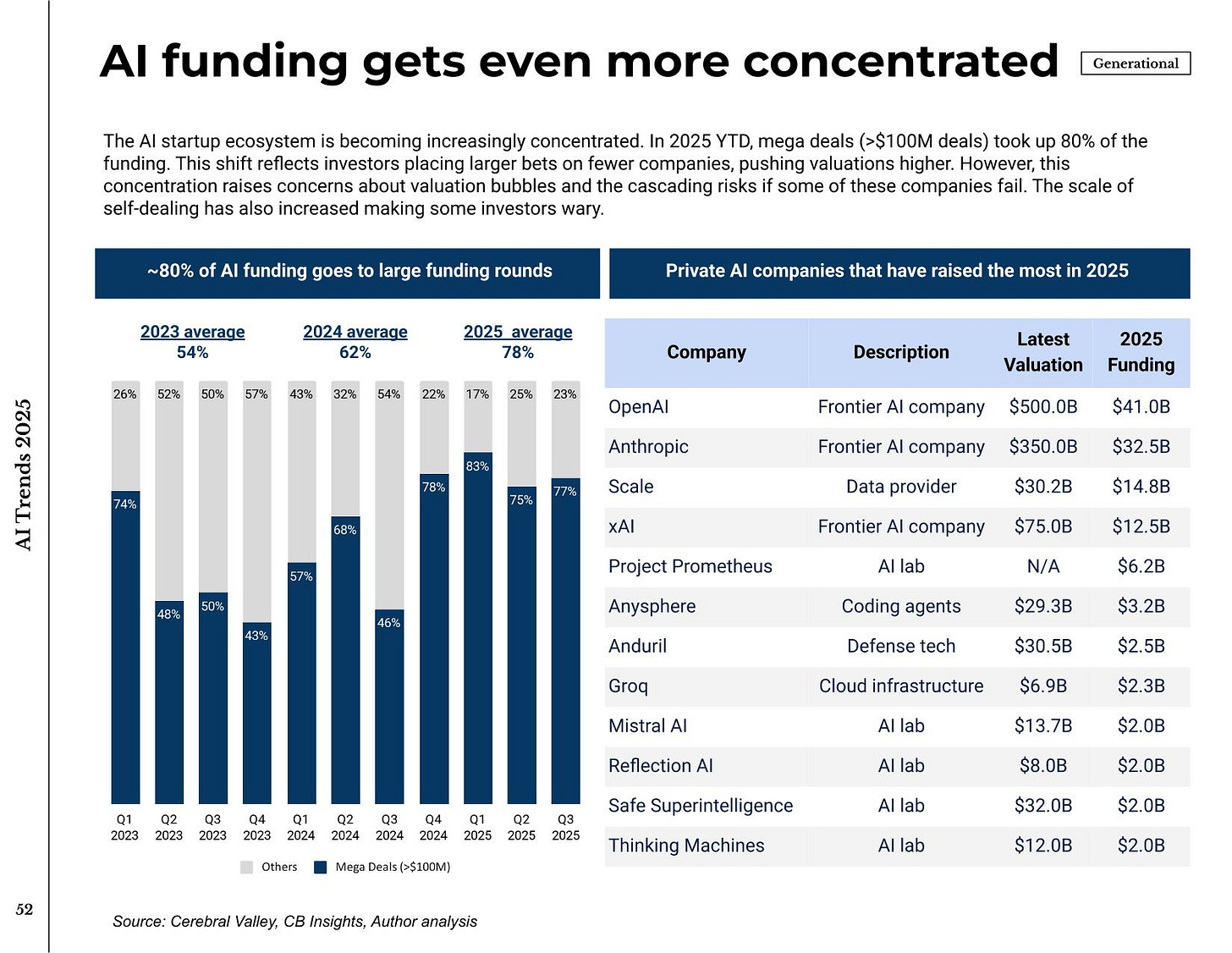

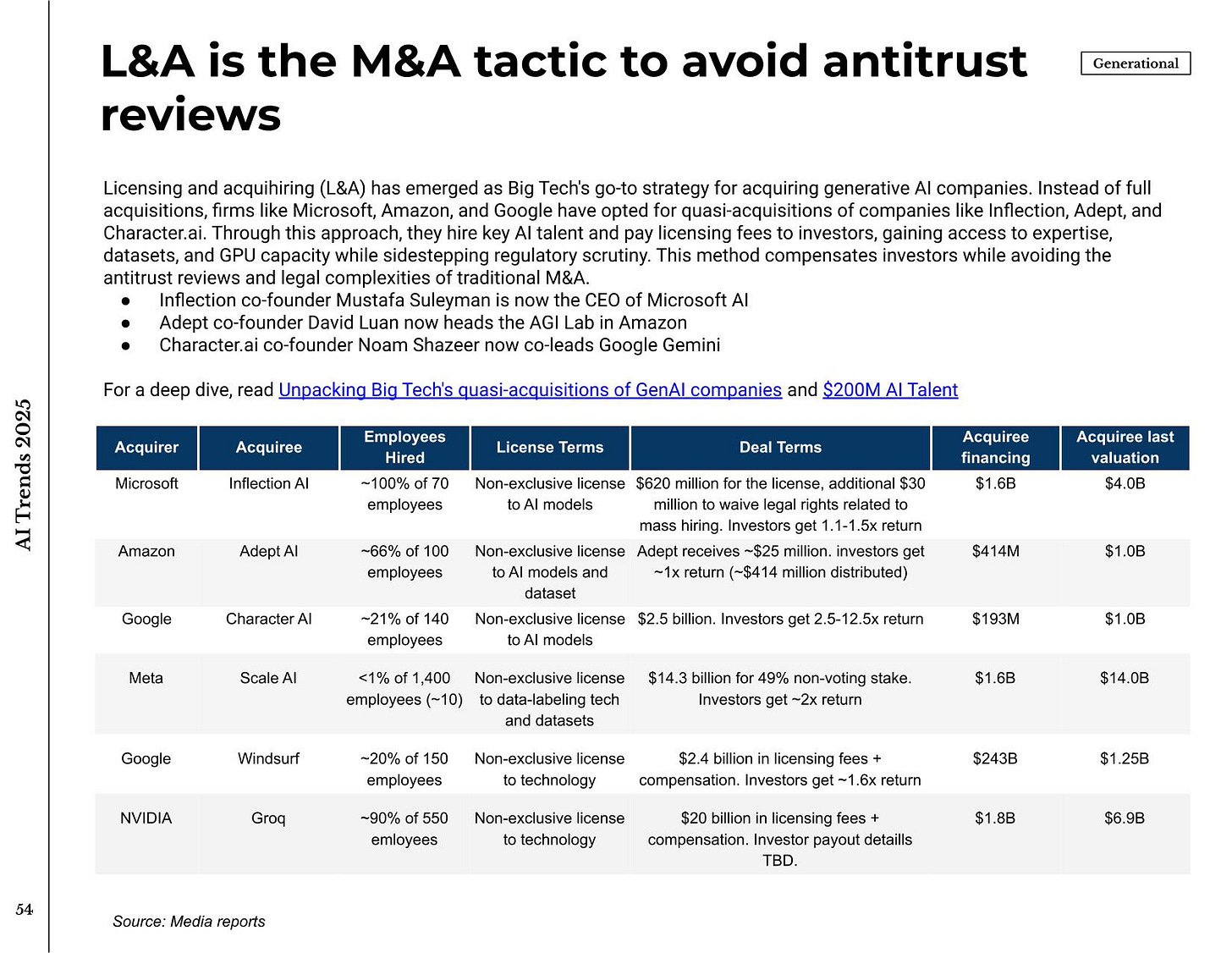

AI exit activity increases 44% from 2023 to 2025, but the biggest value is going to Big Tech acquirers, not newly public companies.

Interesting dynamics: Incumbents are using licensing and acquire-hire structures to avoid antitrust scrutiny. Microsoft’s deal with Inflection AI became the template – they hired key employees and licensed the technology without a formal acquisition. This effectively transfers the most important assets while avoiding regulatory review.

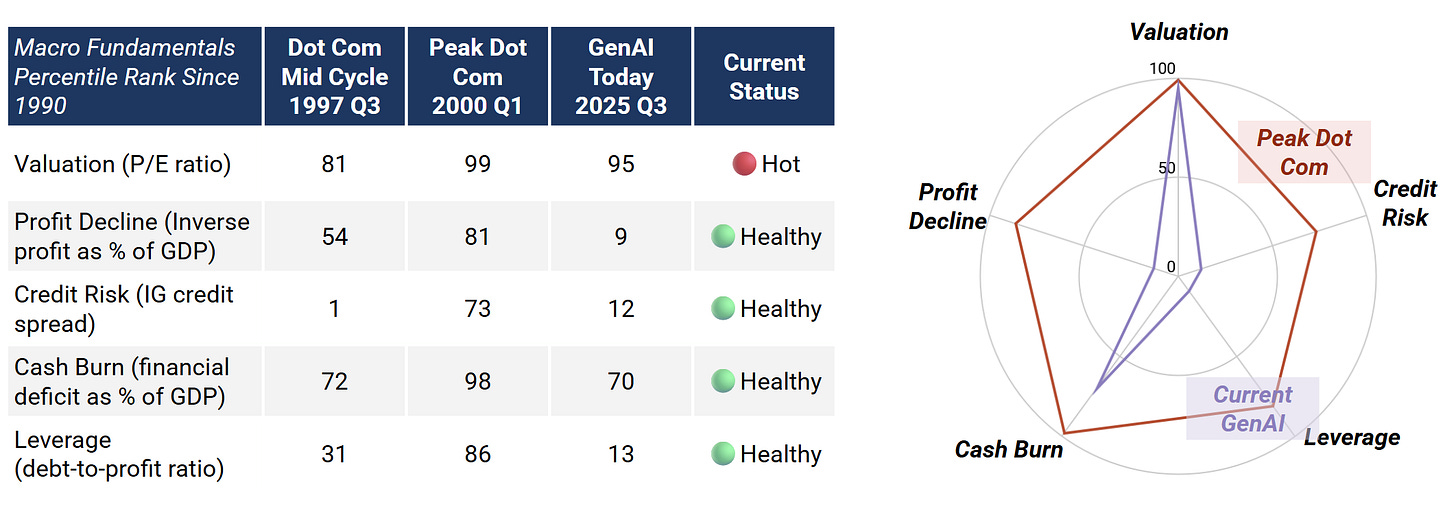

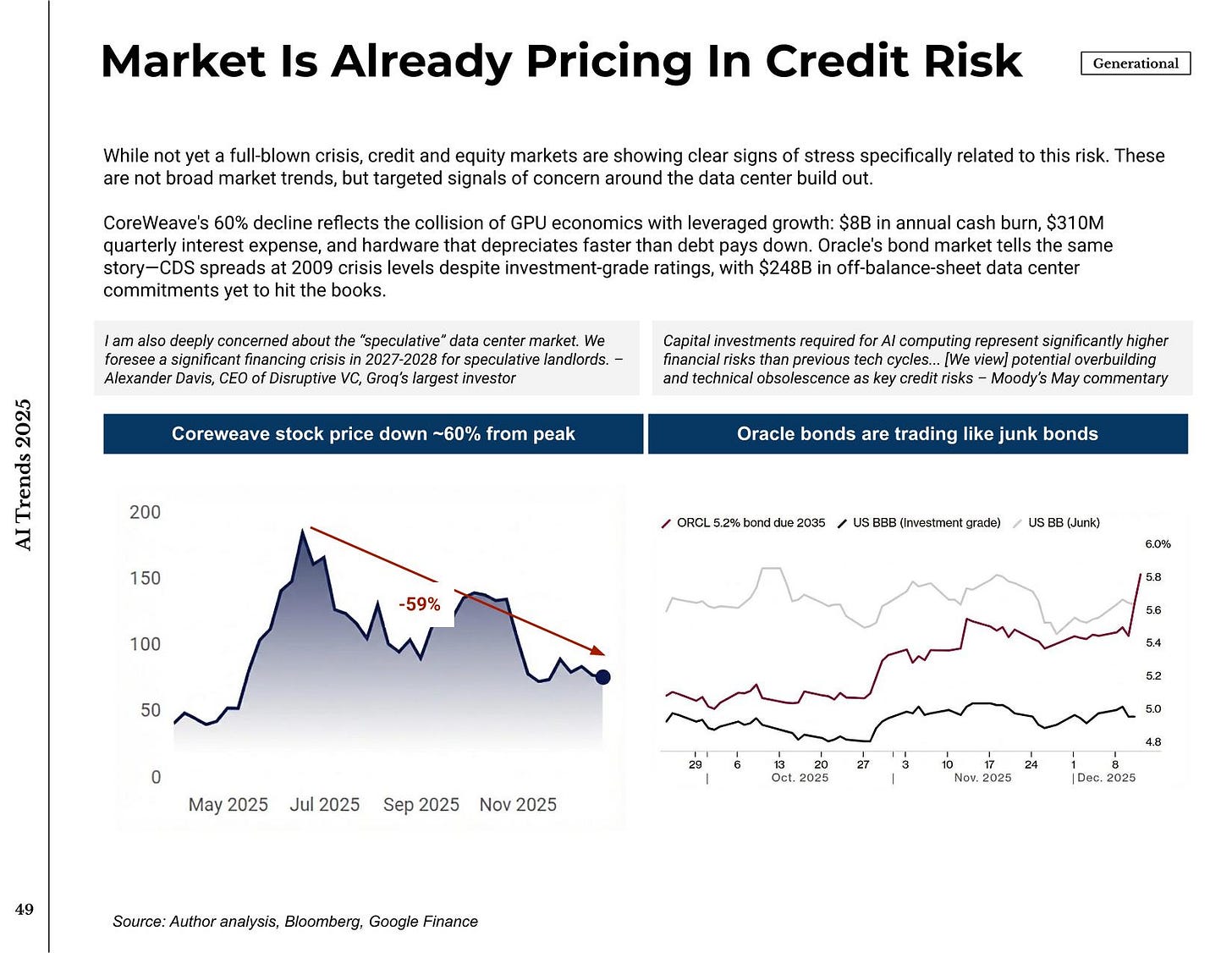

Valuations are very high—95th percentile on the Goldman Sachs bubble framework. But other indicators that typically precede a decline (profit decline, credit risk, leverage) remain healthy. High valuations alone do not cause declines; There are deteriorating fundamentals.

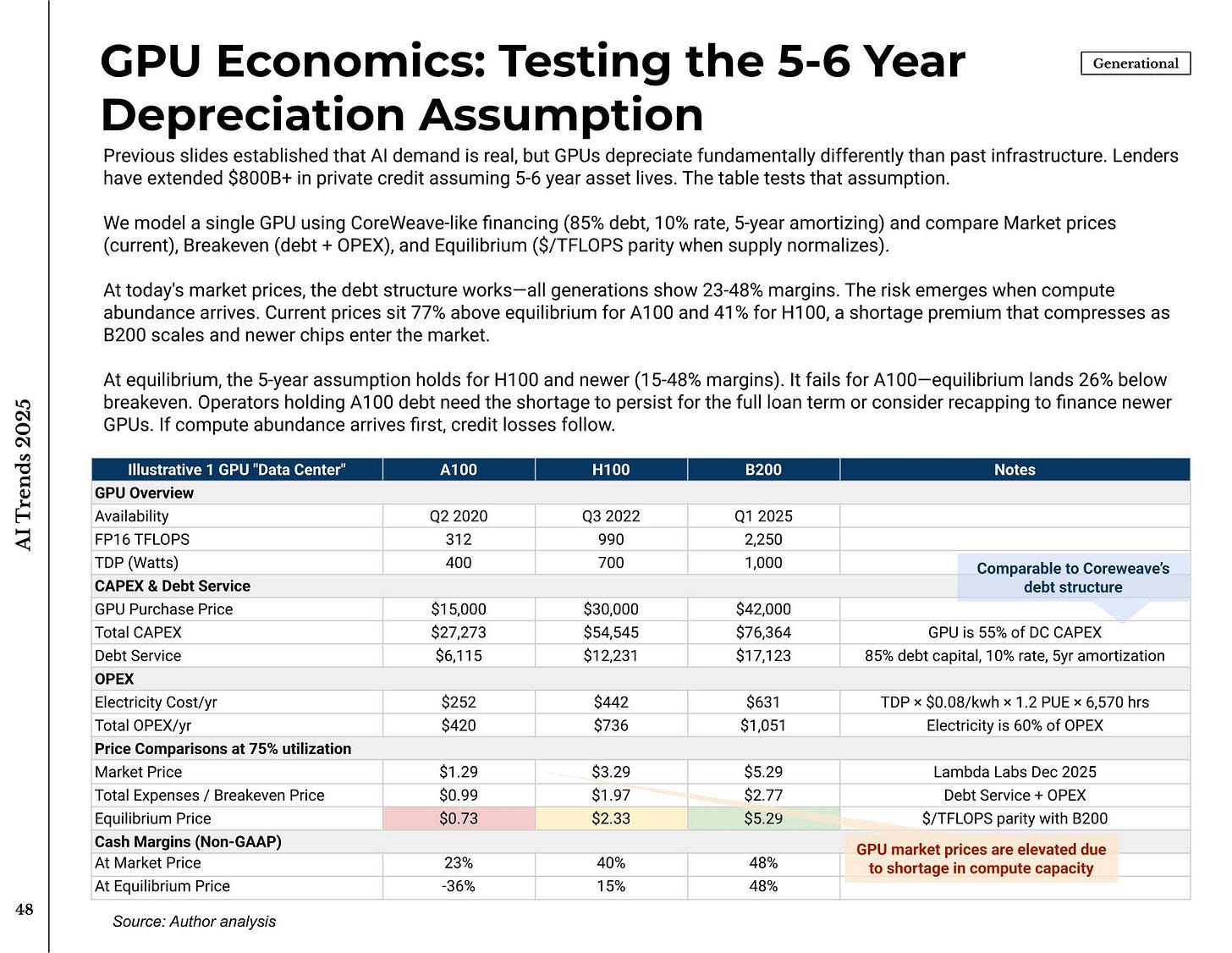

The new risk factor is asset lifetime. The telecom bubble left behind fiber optic cables with a useful life of 25–30 years. The AI boom is built on GPUs having a lifespan of 2-4 years which rapidly decreases as new chips are released. This makes the capital stock more fragile and more dependent on continued external financing.

I would call the fundamentals healthy but it is worth taking a closer look at the financing structure.

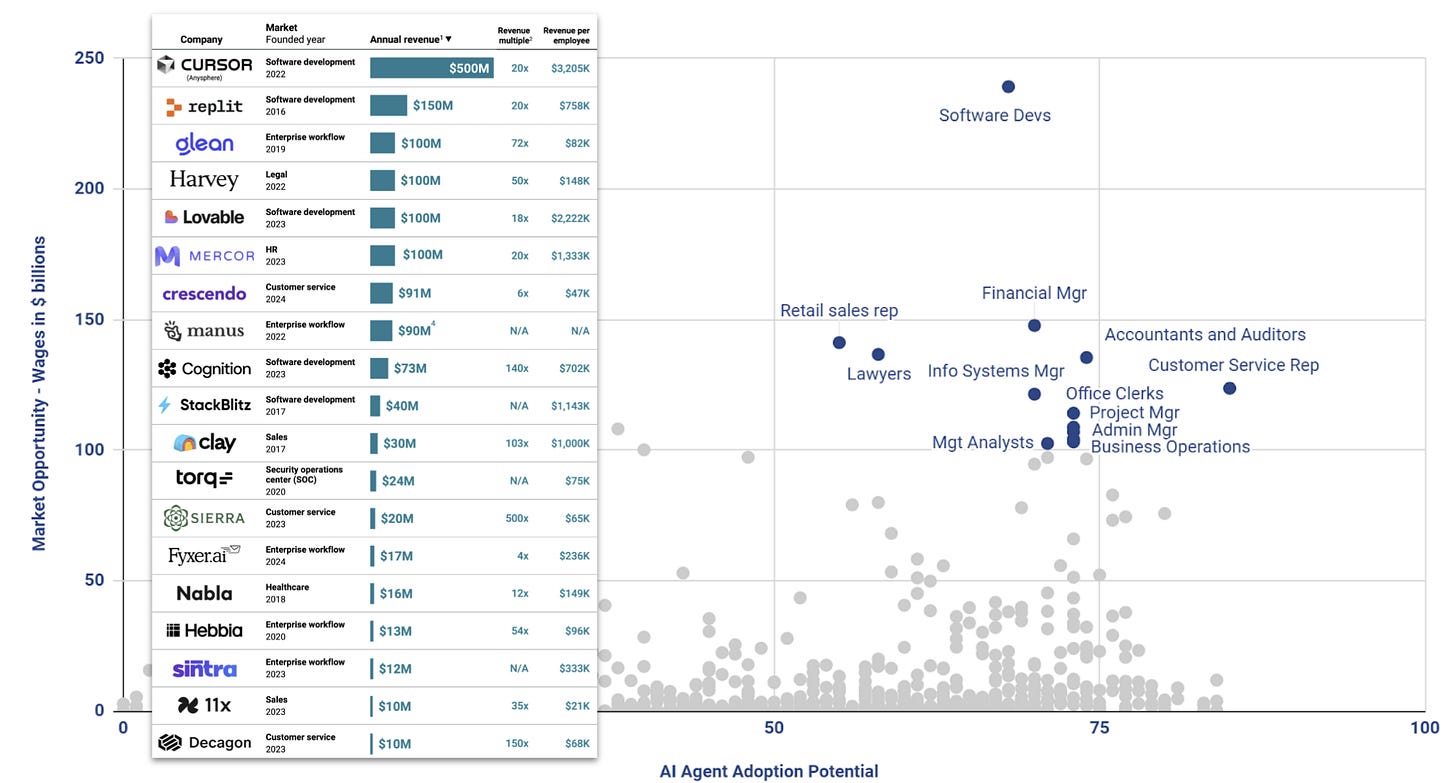

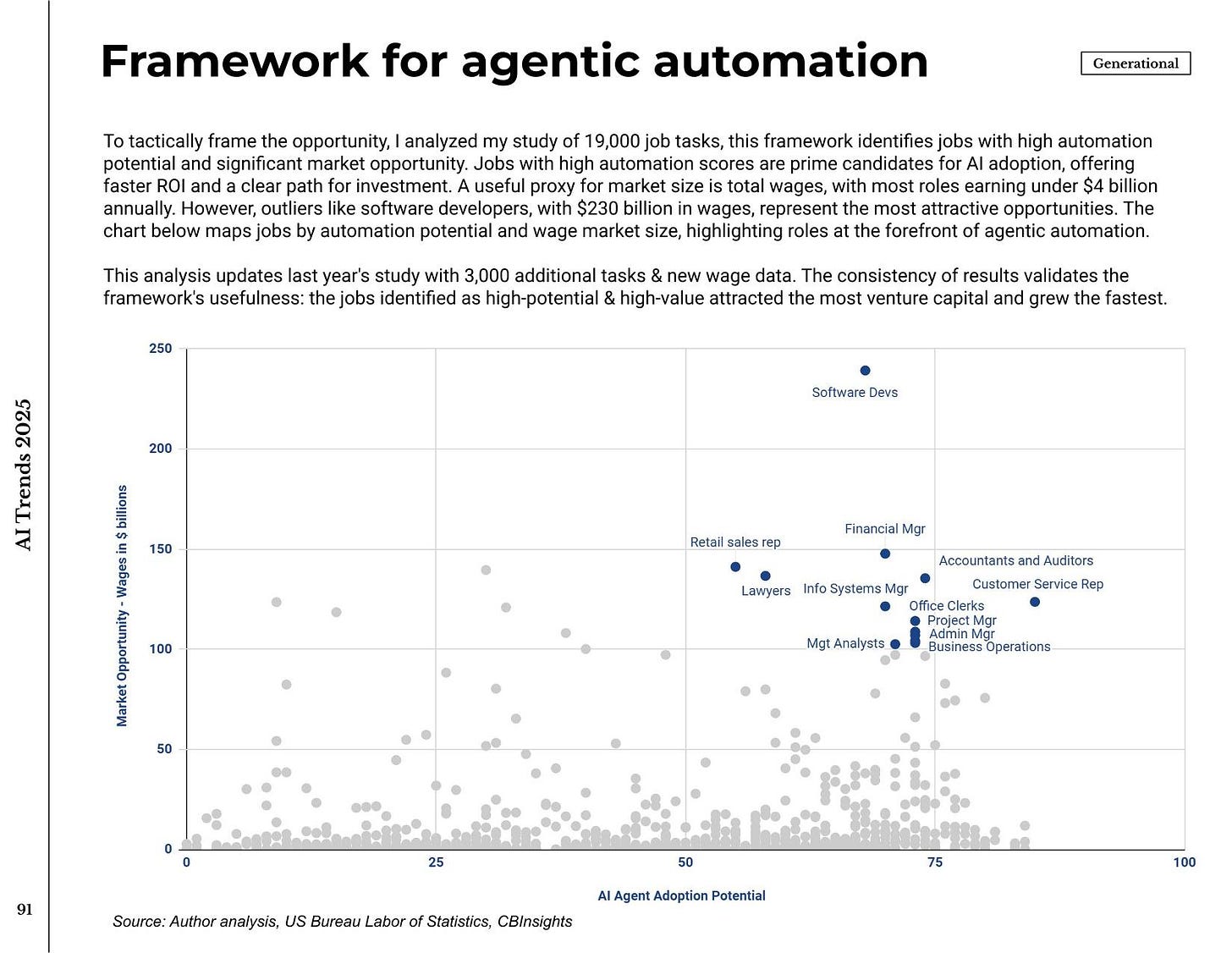

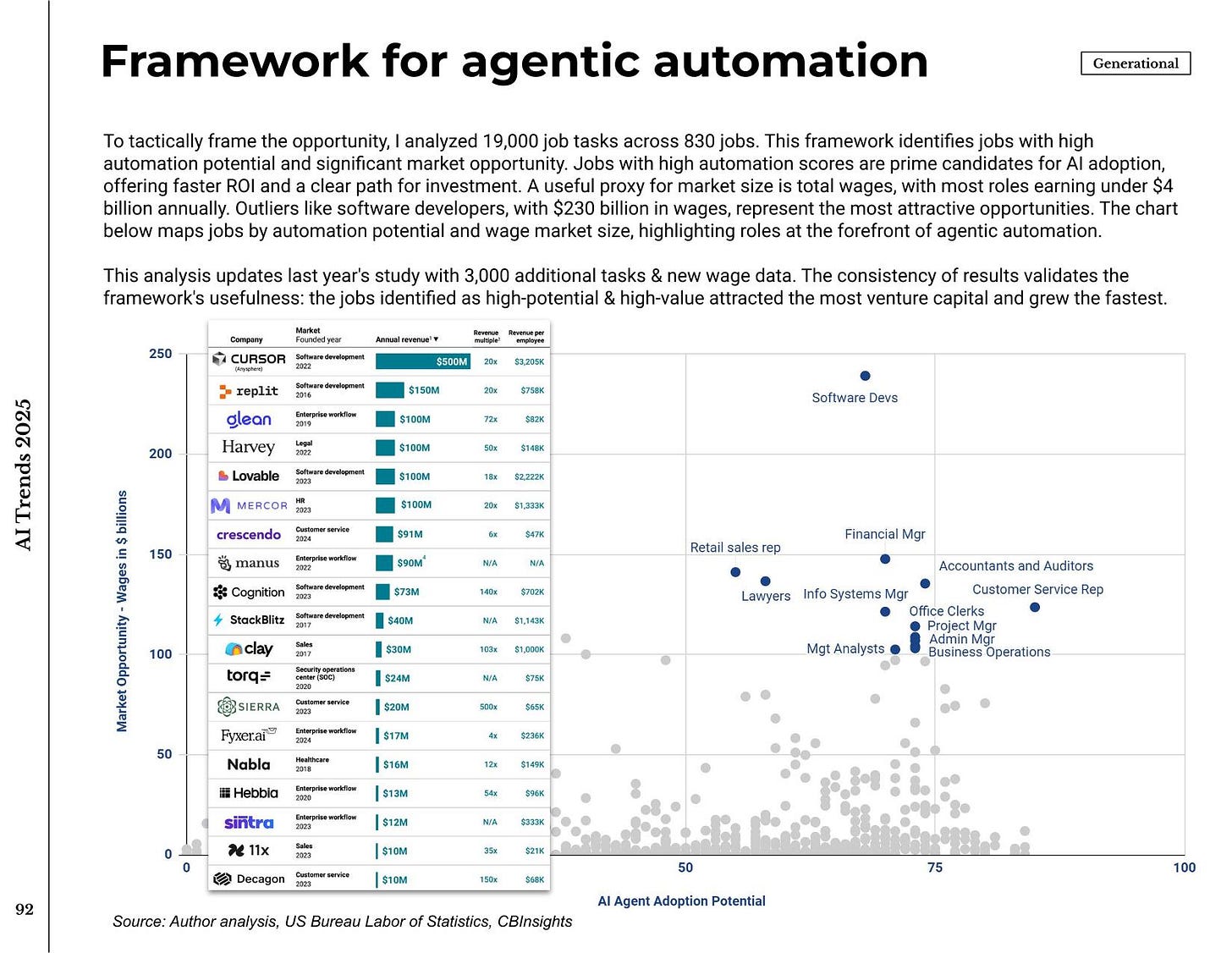

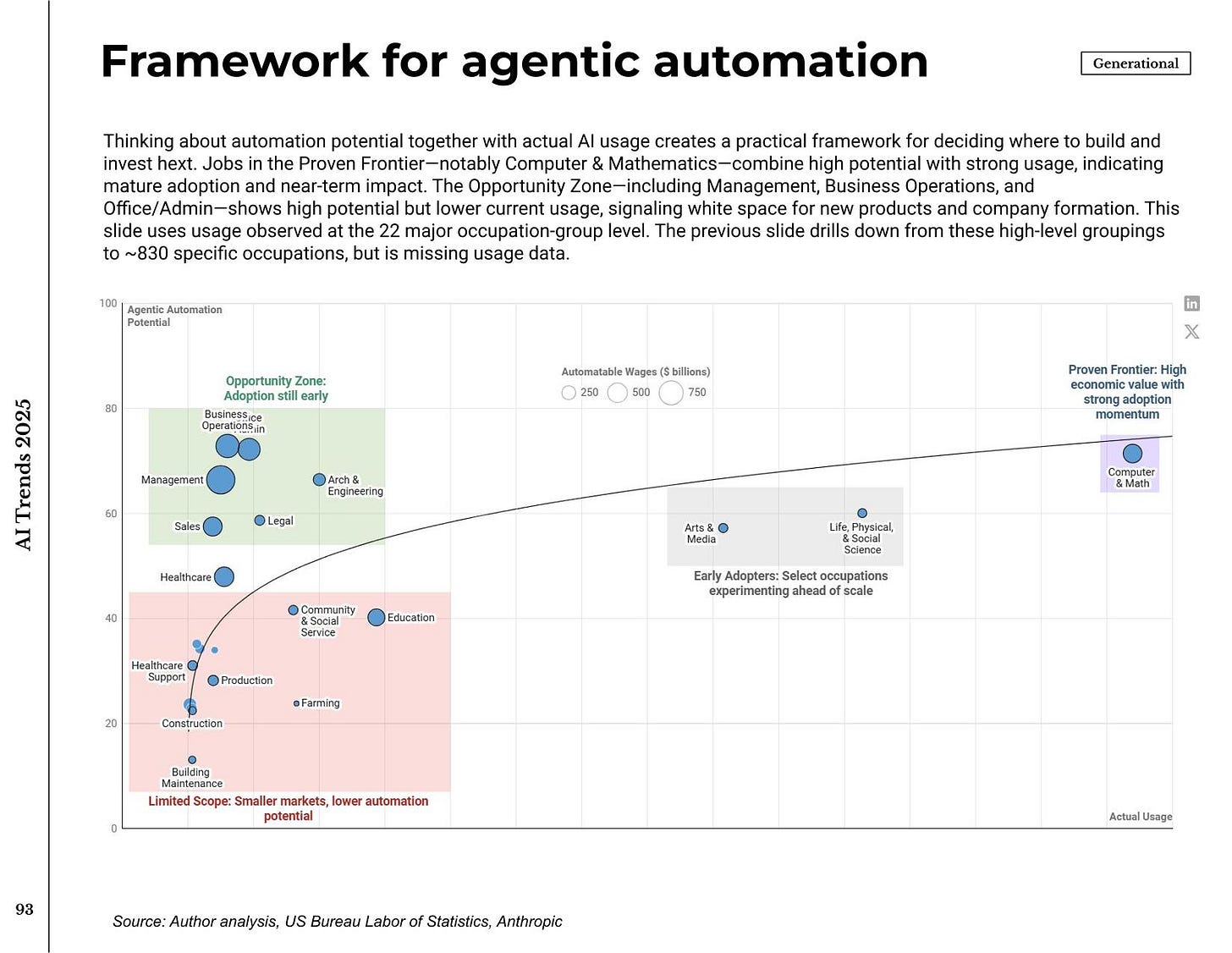

The framework I use: Map job tasks based on automation feasibility against total wages paid for that role. High feasibility + large salary pool = attractive target for agentic AI companies.

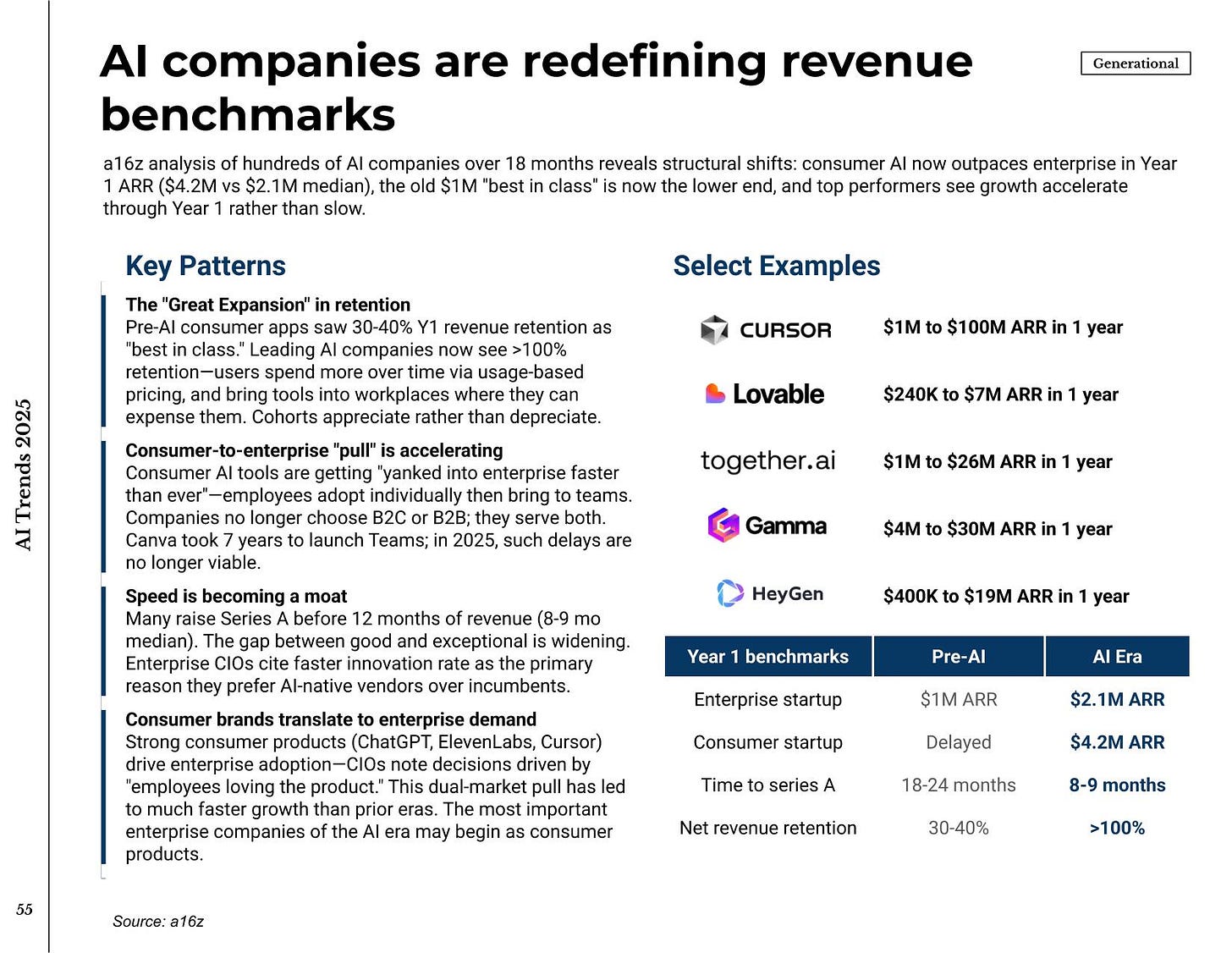

This worked well in practice. The high-potential roles I identified in last year’s report (software developers, financial managers, legal professionals) attracted the most VCs and produced the fastest-growing startups—Cursor, Harvey, etc.

The data on adoption, labor displacement and infrastructure strain all point in the same direction. Open questions are about speed and constraints – how fast energy infrastructure can scale, how financing structures hold up, and which verticals see the most disruption next.

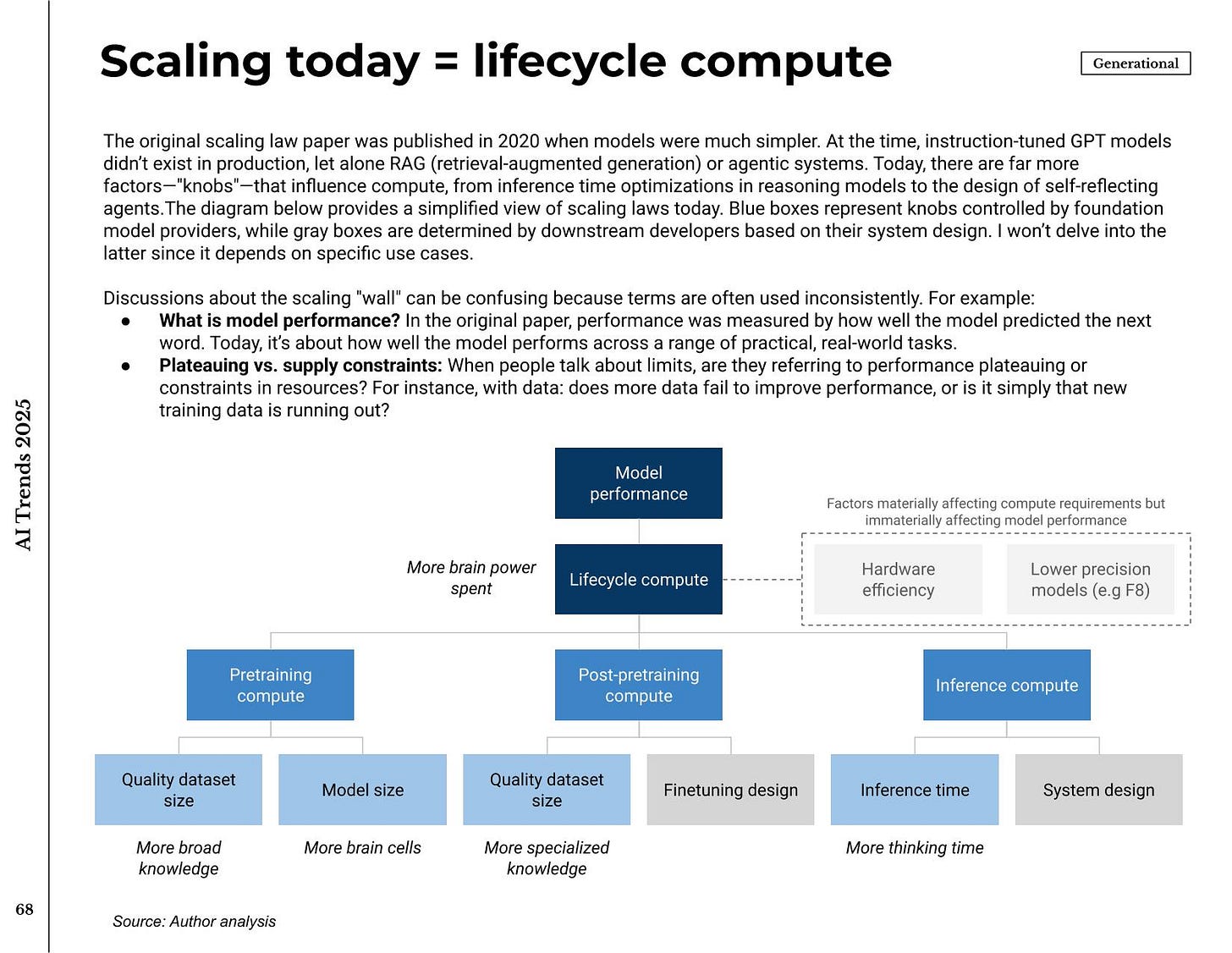

There’s more in the full report: in-depth information on scaling laws, sector-by-sector breakdowns, and a market map of 1,800+ AI startups. What I’ve covered here are just the findings I thought were most worthy of attention.