Unlock the free White House Watch newsletter

Your guide to what Trump’s second term means for Washington, business and the world

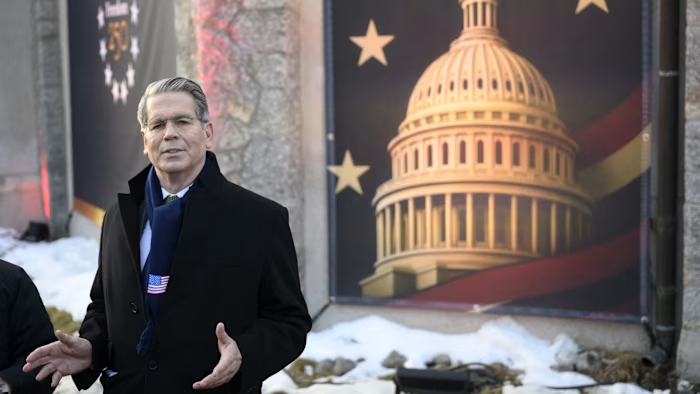

The US Treasury Secretary has rejected the EU’s ability to quickly agree on a forceful response to Donald Trump’s Greenland-related tariffs, predicting the bloc would likely form a “dreaded European working group” rather than take swift action.

Scott Besant suggested that the slow decision-making of the Group of 27 nations would hinder its ability to mount a forceful response or immediately use the so-called anti-coercion tool, its strongest trade measure.

“I think they will first create the dangerous European Working Group, which appears to be their most powerful weapon,” Besant told a small group of journalists in Davos, Switzerland, where she is attending the World Economic Forum.

His comments suggest Washington is not seriously considering the possibility of the EU deploying its most powerful trade weapon, which would allow the bloc to restrict access to the single market for US companies.

“Their speed of decision making is not always the fastest,” Besant said, citing Europe’s continued purchases of Russian fuel. EU is Target To phase out these imports from Russia by the end of 2027 after a sharp reduction in procurement.

Trump’s threat to impose 10 percent tariffs on European states trying to “acquire” Greenland has raised fears of a trade war with the continent, putting transatlantic relations in jeopardy.

Besant earlier on Monday warned the EU that it would be “foolish” to hit back at Trump. The bloc is preparing to impose retaliatory tariffs on €93 billion worth of US exports, which would likely come before any anti-coercion tools are used.

The president will arrive in Davos on Wednesday, where European capitals will debate their response.

The Treasury Secretary said a decision on the next chair of the US Federal Reserve is unlikely to come immediately after Trump’s visit to the Swiss resort.

“I think next week,” Besant said, adding that the administration plans to make an announcement by the end of January.

Besant dismissed the possibility that a renewed trade conflict between the US and the EU would undermine efforts to lower the cost of living for Americans. “Tariffs were the dog that did not bark in terms of price increases,” he said, citing the decline in inflation of core commodities.

“As someone who was a professor of economic history at Yale, I can tell you that (countries with trade surpluses) are always the worst hit in a trade war.”

He said the sale of US government bonds by European holders would be “self-defeating”, amid market speculation that it could be part of Europe’s possible retaliation.

European countries, including Britain, are hoping Trump may back down from his threat to impose 10 percent tariffs from Feb. 1, which the president has said will remain in place unless an agreement is reached to “purchase Greenland.”

Asked whether the US was ready for a negotiated settlement that fell short of gaining control of Greenland, Besant said: “I would take President Trump at his word right now.”

Policy instability in Washington is causing some investors to diversify away from US assets, among them bond group Pimco. Responding to these moves, Besant said US Treasuries had performed strongly last year.

“I can’t comment on what they (Pimco) are saying, but… the US actually had a fiscal contraction last year, while France is not able to get a budget,” he said.